Scalability problem is one of the main issues that has been discussed since the emergence of blockchains. For scaling, various paradigms has emerged over time. Recently, the most prominent paradigm is to execute the transactions on a different chain and to try to share security with the main layer. Throughout the process, Ethereum has provided a great number of solutions to this paradigm. In the beginning, the idea of “state channel” was given attention for some time. However, later, some problems that cannot be solved with state channels were discovered. Due to these problems, “plasma” emerged to replace state channels. Plasma aimed to share security directly with Ethereum, and set out its journey with this goal. But the long period of withdrawals in Plasma (7 to 14 days) and security problems forced the Ethereum side to embrace a novel perspective. That is exactly when the new paradigm we call “Rollups” have emerged.

Modular Block Chains

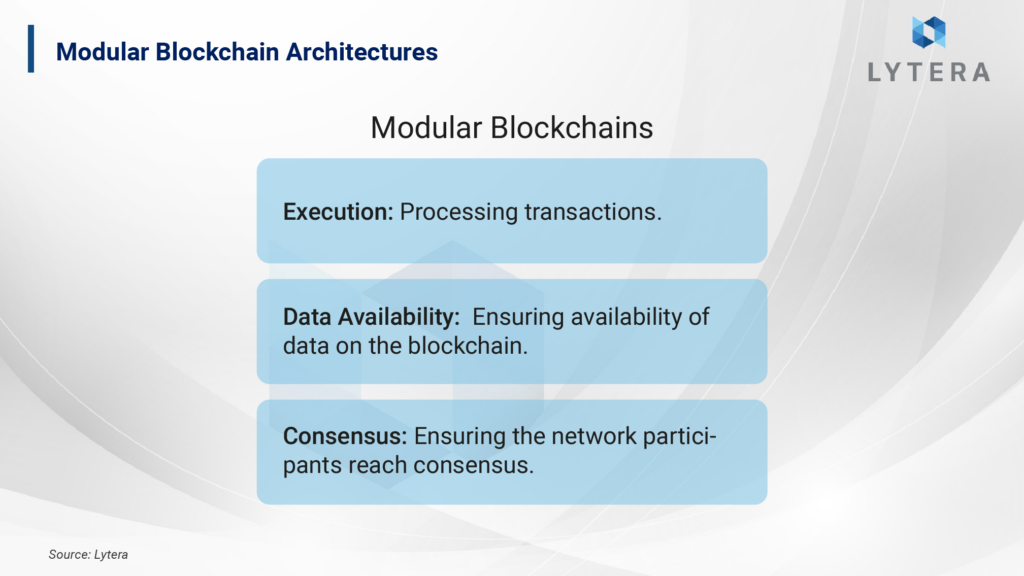

Blockchains basically undertake four tasks: To ensure consensus in the distributed network within the framework of certain rules (consensus), to execute transactions (execution), to guarantee the immutability and secure storage of previous data (data availability), and to ensure settlement (settlement).

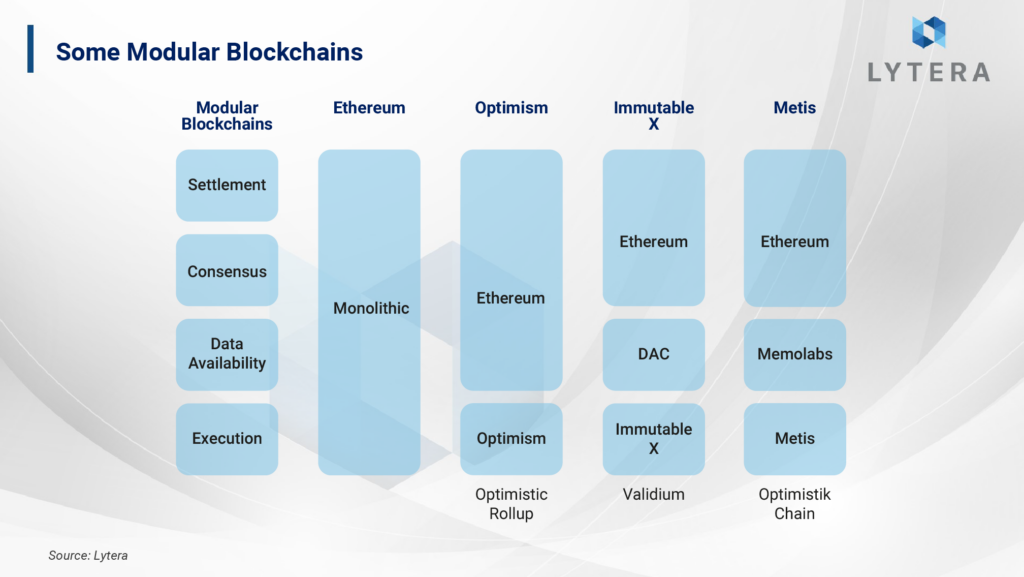

Monolithic blockchains, on which efforts had been made to scale for many years, were facing various obstacles as the attempts were including to render them to carry out all four tasks on them. However, we need a solution different than monolithic blockchains for more scalable networks as monolithic chains could only be scaled by compromising on various things while trying to take on the responsibility of all these four tasks. On the other hand, modular blockchains aim to scale by distributing some of these tasks across different networks.

There are many different approaches with regards to modular blockchains. A modular execution layer could be designed as validium, optimistic chain or rollup depending on architectural preferences. For instance, Immutable X is a layer to solution built on top of Ethereum. While it relies on Ethereum for Settlement and Consensus, for Data Availability, it relies on DAC (Data Availability Committee) developed by Starkware. As such, Immutable X is a Validium built on Ethereum. On the other hand, Optimism utilizes Ethereum for consensus and data availability while using its own chain for execution; hence, it works as a rollup. It is possible to increase the number of these examples; but our priority should be to take a look at the economic process of layer two solutions.

Types of Rollups

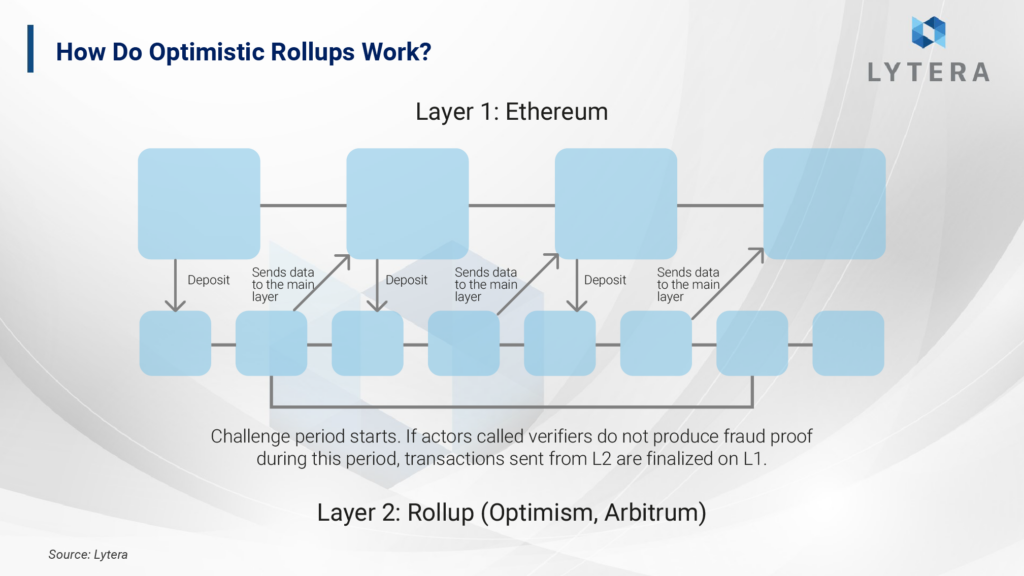

Rollups are main structures taking on the execution role in modular blockchains. Rollups are responsible for validating the transactions by the users and sending the data of these validations and proofs to the mainnet. These processes are carried out through different mechanisms by Optimistic and ZK Rollups.

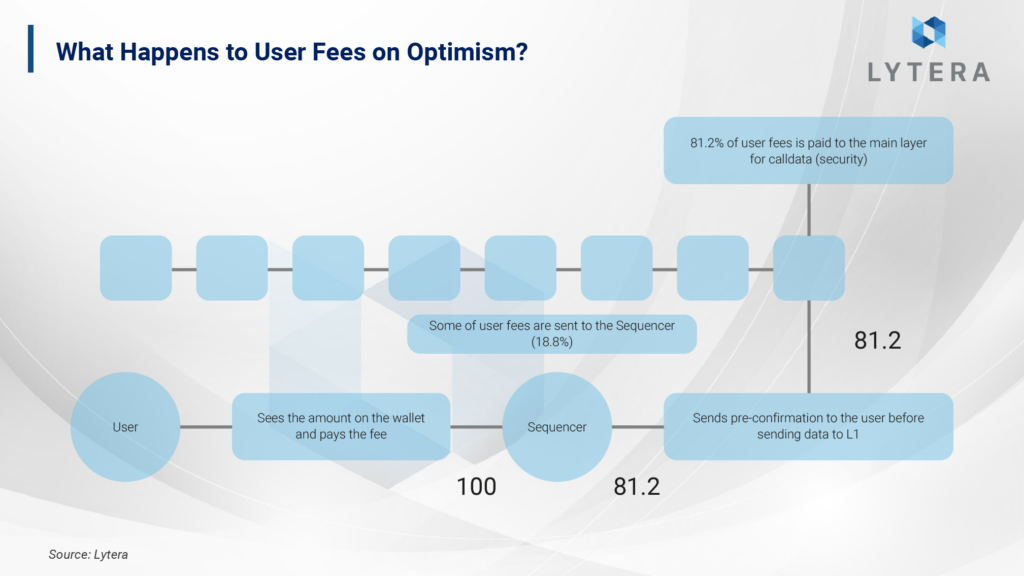

- In the case of Optimistic Rollups, when a user interacts with the Rollup, the transaction is initially met by the actor called the “sequencer”. The Sequencer is responsible for, well, sequencing the transactions, collecting the transaction fees paid by the users, batching transactions to send them to the mainnet. Transactions sent to the main layer are assumed to be valid. And actors called Verifiers check whether the allegedly valid transactions are actually valid or not. For data and proofs sent to the main layer, a certain amount of transaction fee is sent by the Sequencer to the main layer.

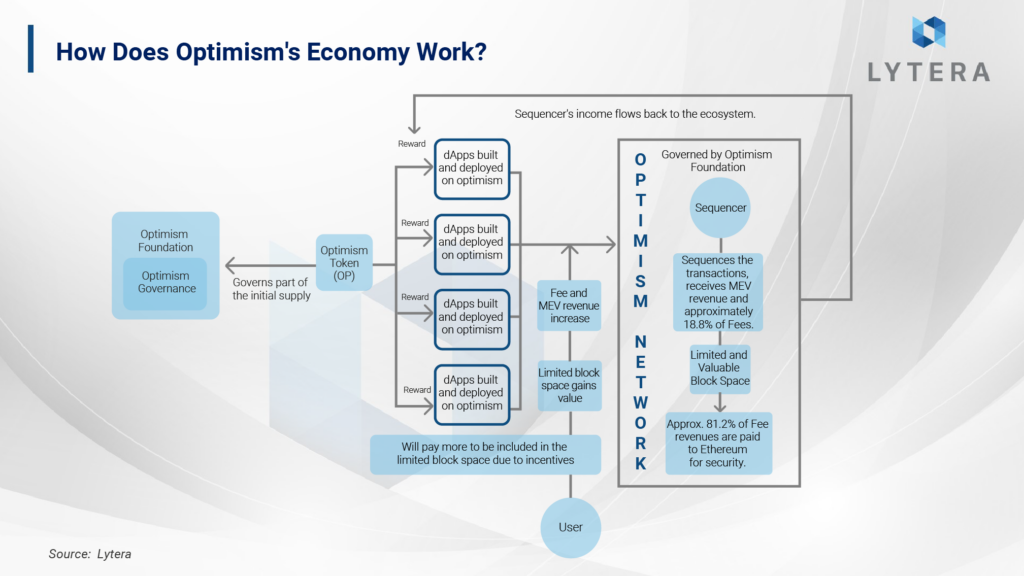

While 18.8% of the transaction fee by the user on Optimism is sent to the Sequencer, 81.2% is paid to Ethereum as security (CallData) fee. Since right now, the only Sequencer operating on Optimism belongs to Optimism Foundation, 18.8% of the deducted transaction fee is directly sent to the treasury of the foundation. And the foundation distributes the commission revenue collected through the transaction fees paid by the users to teams building stuff for public goods.

In the case of Zero Knowledge Rollups, again, the Sequencer is responsible for sequencing the transactions. Proof of the sequenced transactions is proved by the Prover using a specific cryptographic method called Zero Knowledge, and verified on the main layer. In order for the transaction to be verified on the main layer and for the data to be called, the prover pays an additional transaction fee on the main layer. Unlike Optimistic Rollups, there are additional costs for generating the zero knowledge proof. Currently, none of the active Layer 2s (except for Fuel v1) has a decentralized and permissionless mechanism allowing everyone to produce blocks and proofs. The main reason behind this is that modular blockchains are only taking their baby steps and have not been subject to intensive tests in terms of security.

The common feature of both rollup models is the fact that they are required to pay a certain amount of transaction fee in order to be able to share security with the main layer. This is the main issue that differentiates rollups from layer two projects as well as complicating their tokenomic models. Decentralization of sequencer and prover mechanisms on rollups raises the issue of the sustainability of these platforms as an additional cost would be required for “decentralization” on top of the costs paid to the main layer for security. In this regard, we will be examining the questions such as why decentralization is necessary, how to provide a sustainable token model, and whether a rollup, claiming to share security with the main layer, can be censorship resistant without being decentralized in four sections.

- In the first two sections, we will take a look at the token models of layer two solutions that have been working so far. We will examine how these tokens are used and discuss the value creation. In this section, we will be looking at Optimism (OP), Metis, and DYDX in detail.

- In the next section, we will be discussing an alternative layer two token value creation focusing on Zkporter and Arbitrum Nova.

- And in the final section, we will discuss the token models of Starknet and Fuel (inflationary vs. deflationary token models).

Layer 2 Tokens

Optimism

Basically, the scalability problem in blockchains can be divided into three parts: Limited transaction capacity on the execution layer, limited capacity in the data layer, and the problem in the scalability of consensus. Ethereum has been working on a scalable and environmentally friendly consensus algorithm and sybil-resistance mechanism for many years. Indeed, with the Merge, Ethereum actually achieved a more scalable (currently, there are 450.000 validators on Ethereum) and environmentally friendly (approximately 99% drop in energy consumption) consensus algorithm and sybil-resistance mechanism. Although the Merge is significant in terms of Ethereum’s future, the limitation on execution and data capacity, which are the bottlenecks of Ethereum, still remains. Optimism is trying to overcome this bottleneck in the execution layer by providing EVM equivalence. With the Bedrock upgrade, expected to be released in Q4 of 2022, we will see many advanced updates of Ethereum protocol and gEth equivalence on Optimism.

Optimism Backers

For some time, Optimism team worked on a plasma solution as a nonprofit group of researchers under the title of Plasma Group. Then, they shut down Plasma Group to form a new company structure under the title of Optimism. At the incorporation, Optimism received $3.5M investment during the investment round led by Paradigm. They received $25M in the series A funding round led by a16z. In their series B investment round led by a16z and Paradigm, they received an investment of $150M on the basis of $1.7B valuation.

Shortcomings of Optimism

Since Optimism is an optimistic rollup in its current architecture, the users believe they are on a network as secure and censorship-resistant as Ethereum; however, this is not the case.

- There is no operational fraud proof mechanism on Optimism right now. It is still under development. As there’s no fraud proof mechanism, users need to trust the Sequencer run by Optimism foundation for the security of their transactions. While users are expecting to be under Ethereum security, they are faced with a poor security infrastructure, even worse than most sidechains.

- At the design stage, the idea for rollups was to build an architecture in which central actors may not freeze users’ assets or censor them. In theory, this is enabled by allowing all users to directly interact with the contract on Ethereum and to withdraw their assets to the main layer. However, in the case of Optimism, this function can only be performed through the wallets specified by Optimism Foundation. That is, Optimism is not as secure as Ethereum, nor is it as censorship-resistant as the Mainnet!

Optimism Tokenomics

On 31 May, Optimism token was launched with a large airdrop. During the launch, WinterMute, one of the largest market makers in crypto markets, accidentally got 20 million $OPs stolen. The reason enabling the hack was a simple mistake: There are two different types of wallets used to interact with Ethereum and EVM networks, namely EOAs (Externally Owned Accounts) and smart contract based wallets. While the address does not change in EOA wallets by switching between networks, smart contract based wallets (such as Argent and Gnosis Safe) change as they are an entirely different contract on different networks. WinterMute team, forgetting this fact, suffered the loss of 20 million $OP tokens. After the launch, shadowed by this incident, we haven’t been able to see any use case for the token.

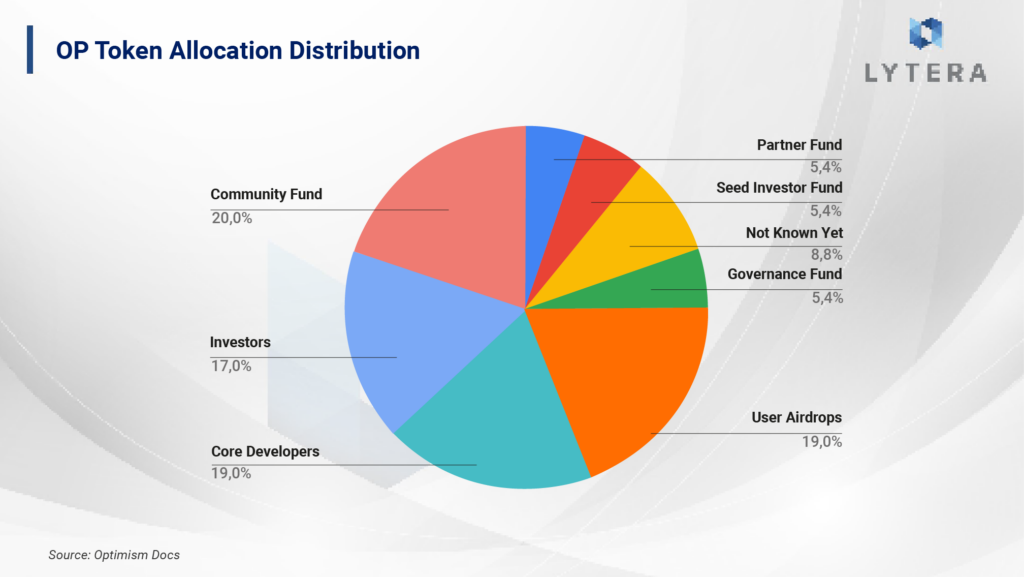

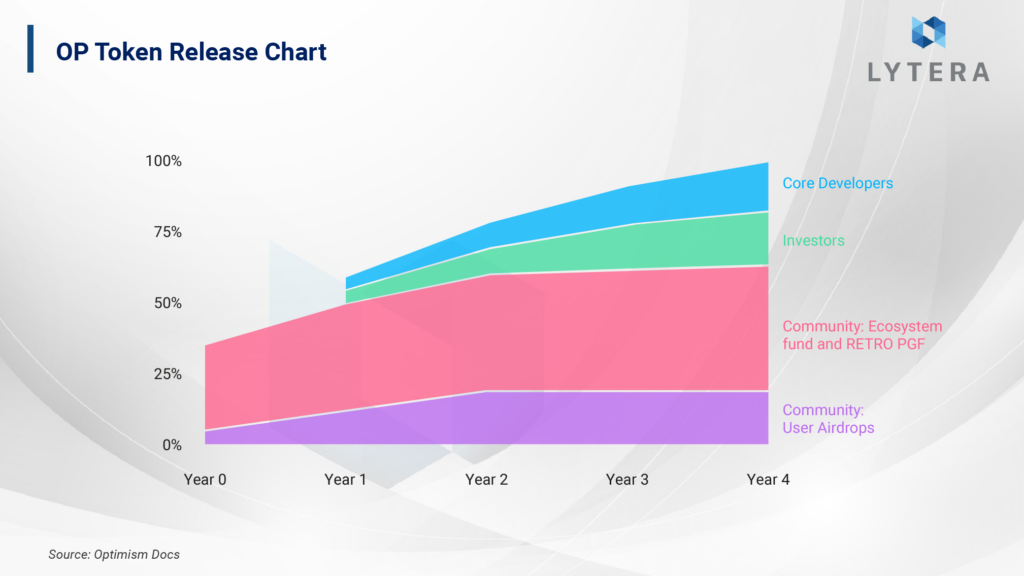

Actually, there are many planned use cases for $OP, the token of Optimism protocol. However, the team’s approach here is different from other projects. While the transaction fees from the centralized Sequencer and MEV revenue is collected by Optimism foundation, token holders do not receive any share from this revenue. Since it is obvious that distribution of transaction fees and MEV revenue to users will create some pressure from the regulatory side of things, the team believes that this revenue should be used for public goods until Optimism network is completely decentralized. So far, $OP token has only been used as an incentive to increase demand for the protocols and for governance votes. It is a major shortcoming for $OP that the token with a huge potential of use cases is merely used for incentives. While it is seen that $OP tokenomics was not designed with a sustainable economic framework, there are also significant problems in the distribution of tokens. For instance, we can see that 56% of the total supply is allocated to insiders.

Although the sustainability of tokens used as incentives and the value created raises some questions, it is possible to say that the token incentives, in fact, significantly increase the activity on the network. $OP tokens are distributed to support the ecosystem. The distributed tokens increase demand for the limited block space. This demand enables the Sequencer that is run by Optimism Foundation to make more revenue. And the revenue is redirected back to the ecosystem (projects working on public goods). It is clear that this model does not add value to the token, but plays a role in increasing activity in the ecosystem. Aware of the fact that it is necessary to add value to the token for a sustainable economy, Optimism team aims to add value to the token through decentralized block production in the future. As it stands, $OP is nothing more than your typical incentive token.

The protocols receiving the Optimism token as an incentive increase demand for the limited block space on Optimism network. Accordingly, the users pay more fees in order to be included in the limited block space. As value created by the token is not redirected to the token itself but to funding public goods, it is possible to argue that the existing economic model harms the sustainability of the token economy.

Optimism in Numbers

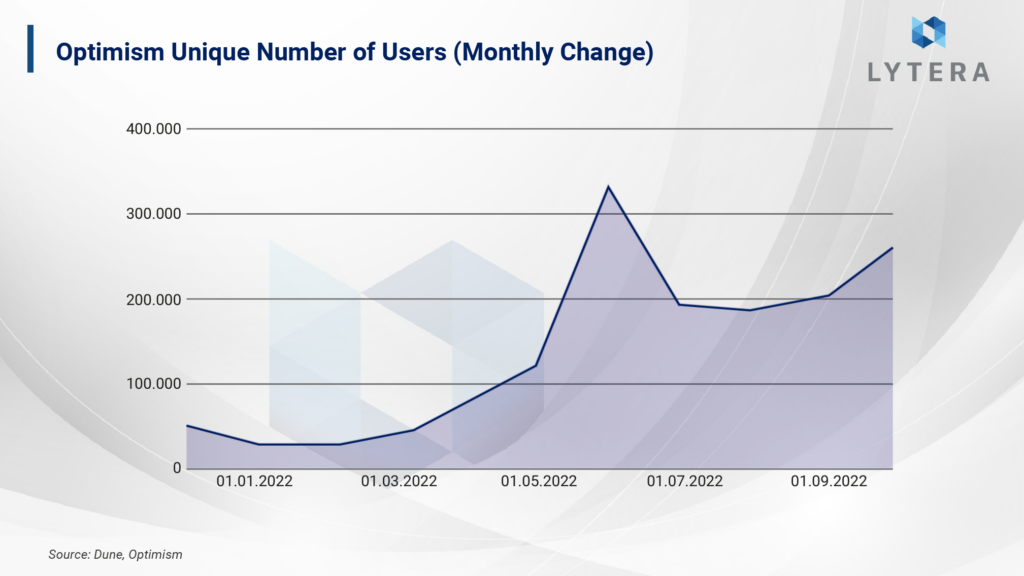

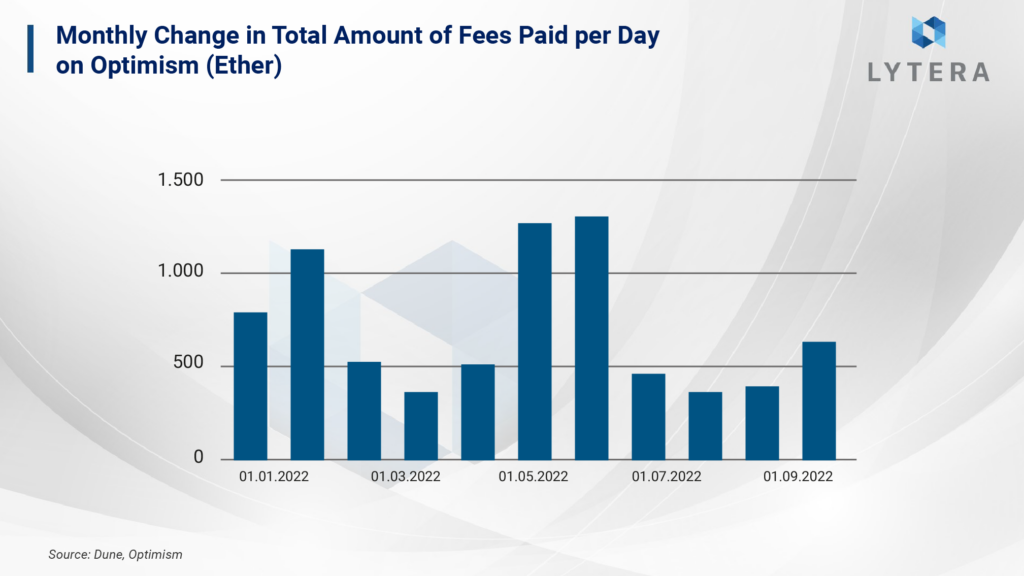

Using the token as an incentive and the airdrop brought a significant user base to Optimism. The month when the token was launched with the airdrop set a new record in terms of the number of unique users on Optimism.

In addition to unique users, the amount of transaction fees paid by the users also broke a record during the airdrop and the token launch. Especially after May, when tokens were airdropped, in June, a new record was set in terms of transaction fee revenue. There’s no doubt that airdrops and incentives have an undeniably positive effect on the ecosystem.

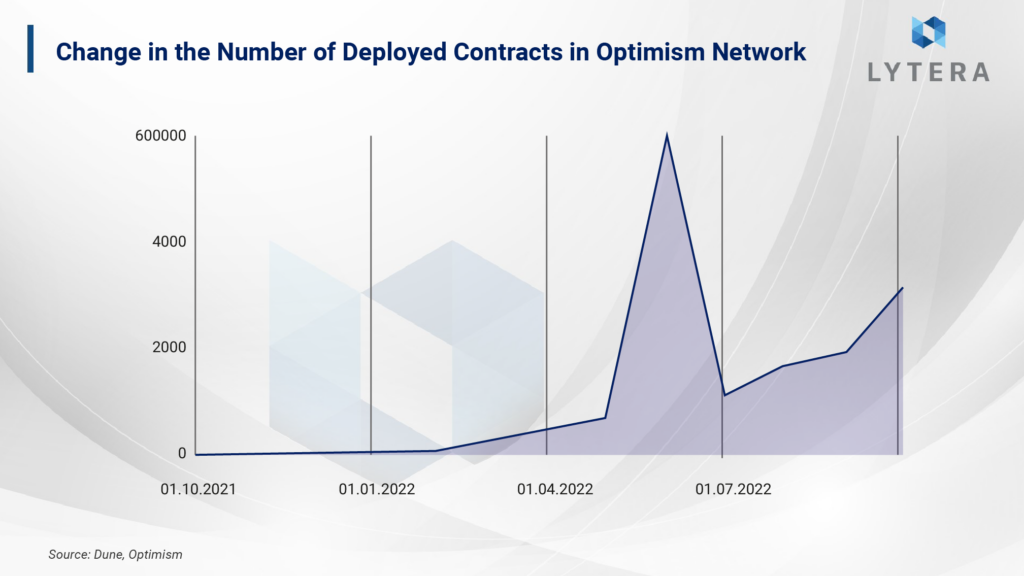

It is also possible to observe an increase in developer activity on the network after the airdrop. The number of contracts deployed peaked in June with 59.000 contracts.

Final Remarks on Optimism

Since Optimism network is still at a rather early stage of development, it has shortcomings such as the lack of a fraud proof mechanism, censorship resistance (permissionless “result proposal” function) and decentralized block production. Despite these shortcomings, we can say that the token has brought significant traffic to the network. Based on Optimism, we can argue that it is better for a Layer 2 network to have a token than no token in terms of attracting traffic and rejuvenating the ecosystem. Although its tokenomics is relatively poorly designed, it is remarkable that $OP has been able to attract a large number of active users and developers to the network.

Metis Andromeda

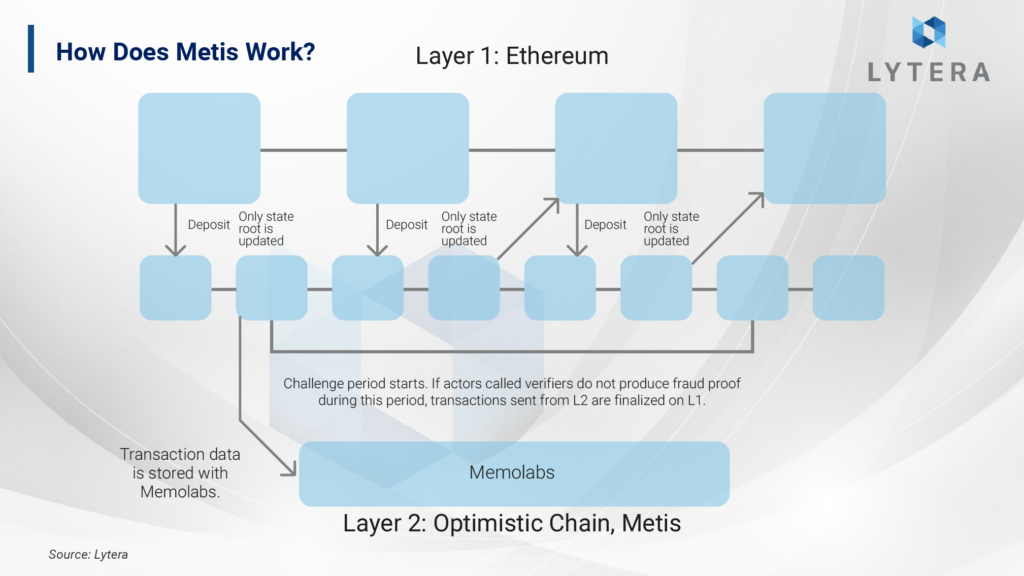

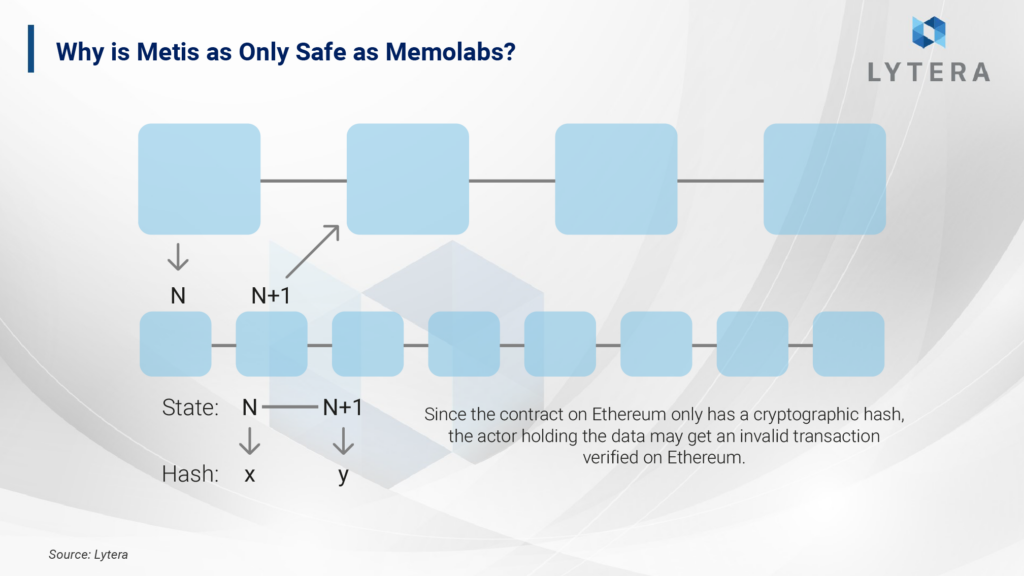

Metis is an EVM-based layer two network, a fork of Optimism. Unlike Optimism, it is utilizing MemoLabs as the data layer since April 2022. Metis also uses fraud proof technology; however since transaction data is not stored on-chain on Ethereum, the validity of contract transactions on Ethereum can only be verified on the condition that MemoLabs provide accurate data. In other words, Metis was designed to be as secure as MemoLabs, and not as secure as Ethereum. This is due to the need for data availability required by fraud proofs.

Shortcomings of Metis

In optimistic structures, the validity of a transaction during a state transition is checked by verifiers. In order for the verifiers to check the validity of transactions during a state transition, the data should be available. These actors may verify invalid transactions as the verifier only has the legacy (old) state root in the event that the actors ensuring data availability are not honest. So, the level of security in an optimism structure is as high as the actor ensuring data availability. Since Metis relies on MemoLabs for data availability, the security of Metis network is not as high as Ethereum, but as high as MemoLabs. This is one of the main shortcomings of Metis network.

Moreover, it should also be noted that Metis does not yet have a fraud proof mechanism developed, and the sequencer is to be trusted for mass exit. Mass exit is a mechanism allowing user funds to be withdrawn to the main layer without being subject to the censorship of the sequencer in case the rollup sequencer attempts to censor transactions. Due to these shortcomings, Metis is called an Optimistic Chain. In other words, it is not as secure as an optimistic rollup, validium, or zk rollup. Checking the roadmap of Metis, the planned actions against these shortcomings seems to be quite limited in number. In its current architecture, it is not possible to say that Metis is a secure chain.

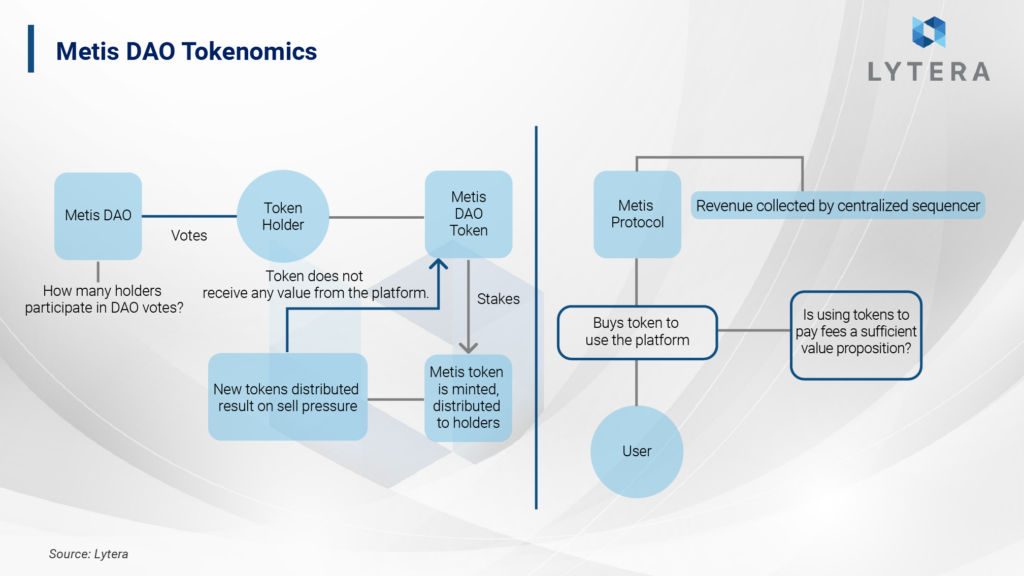

Metis Tokenomics

Unlike $OP token, $Metis has two additional use cases apart from being used as an incentive token:

- $Metis token for Transaction Fees: The fact that a layer two project built on Ethereum forcing people to use its token for transaction fees (except for those using Account Abstraction) results in a rather poor user experience. Poor user experience is due to the fact that users have no other choice but to use $Metis tokens to make transactions on Metis network. Users wishing to use Metis network first have to swap their Ether on Ethereum network with $Metis tokens, and then use the bridge. Obviously, this use case is not ideal. It would be way healthier in terms of user experience if Metis allowed users to pay transaction fees using multiple tokens as in the case of Zksync and Starknet. However, at the end of the day, forcing people to use their own token on their own platform (as in sidechains) could not be regarded as a bad choice as the network is merely as secure as MemoLabs, and not as Ethereum.

- Stake Yield: It is difficult to say that allowing high stake yield for a token is a sustainable economic model. A token to share revenue with the platform and the platform having high profitability could be argued among the main factors for sustainability. It is necessary that the network be used intensively by the users, generate income, and distribute the income with the token holders. Offering nothing more than high yield makes the token economy resemble a ponzi model. We can observe that $Metis, a Layer-2 token not exactly associated with the value created by the platform, cannot go beyond the typical DAO tokens.

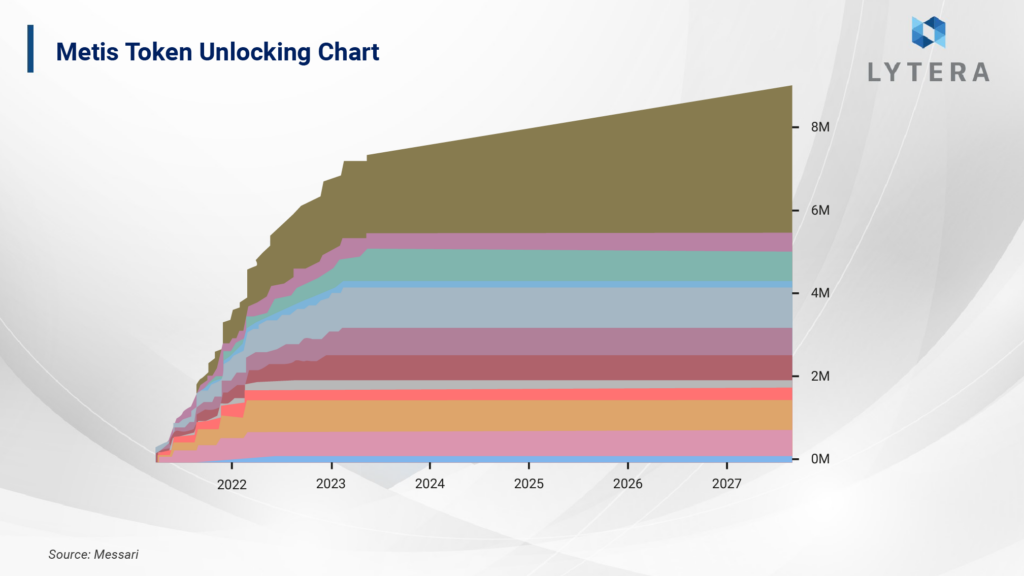

When we take a look at the unlocking schedule, we can see a structure with high inflation. That is, what we are seeing is an annual circulating supply inflation of over 50% by 2024.

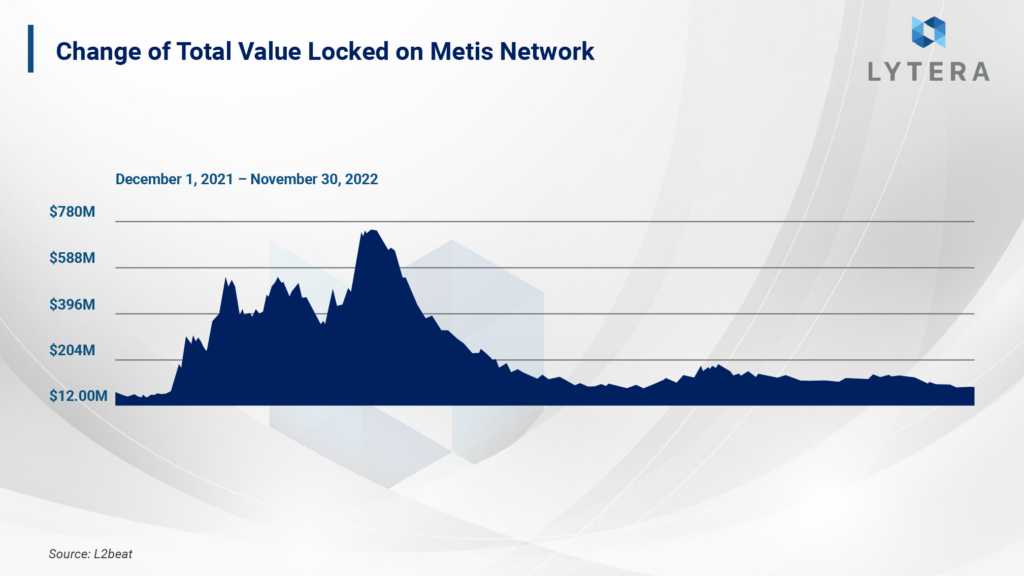

Metis in Numbers

Metis is the fourth largest layer two project in terms of TVL. This TVL consists of the following: 49% $Metis tokens, 44% stablecoins, and 5% Ether. The activity on Metis, the ecosystem of which predominantly consist of DEX and Lending platforms, is lower compared to its competitors.

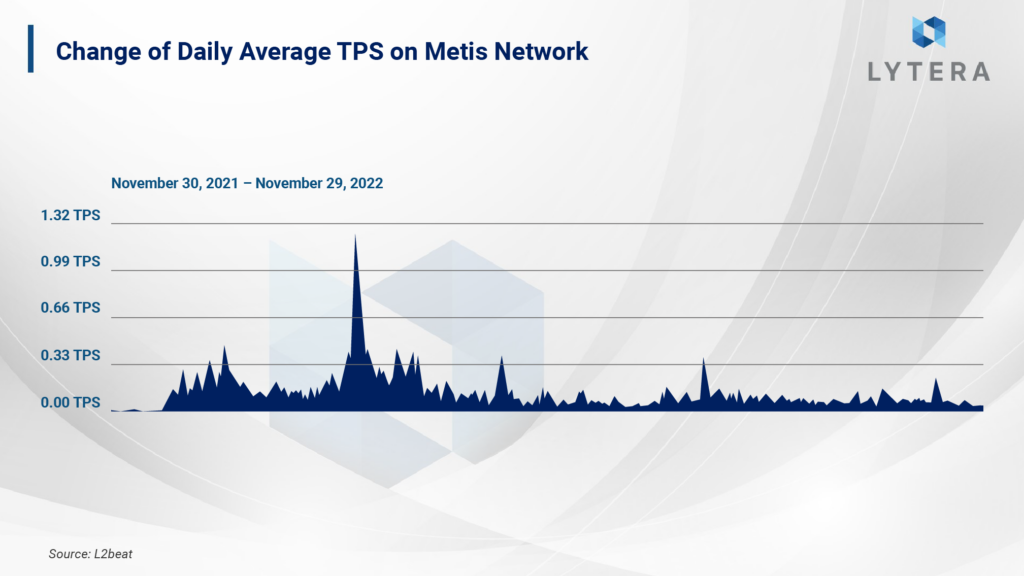

We can see that the transaction per second (TPS) of the protocol is around 0.1. In other words, only 1 transaction is performed on Metis approximately every 10 seconds. It is possible to say that Metis ecosystem is still in its earlier phases of its journey as it ranks 11th among layer two solutions in the TPS ranking.

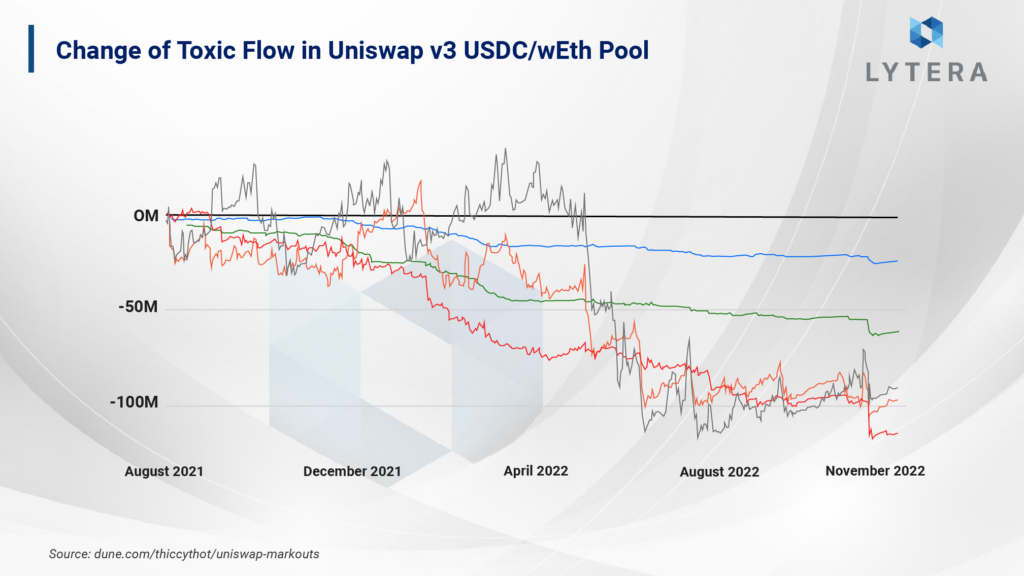

DYDX

Decentralized exchange idea is one of the most important areas of DeFi that has been attempted to be developed for years. Although there were projects trying to match orders on-chain before DeFi summer, they weren’t adopted by the users as they could not be scaled sufficiently. With the AMM (Automated Market Maker) architecture developed by Uniswap, decentralized exchanges have become available to end users. AMMs are a great innovation, but they are not an efficient or an ideal structure in terms of capital efficiency. Due to the disadvantages of the AMM algorithm of Uniswap v3, liquidity providers in ETH-USDC pool have lost more than $80 million! For this reason, it is an undeniable fact that the blockchain world needs a decentralized, order book-based and scalable decentralized exchange.

That is exactly where DYDX comes into play. DYDX works as a rollup providing services with the Starkex infrastructure offered by Starkware. Starkex is an infrastructure that works as SaaS (Software as a Service) enabling the development of application-specific chains. DYDX, developed with Starkex, is regarded as a rollup as it stores data on Ethereum and built on Ethereum.

DYDX Backers

DYDX, which launched as a Layer 1 named Solo in 2017, continued to serve as an application-specific chain allowing futures trading using Starkex engine of Starkware.

Having completed a total of 4 investment rounds, DYDX’s investors include the largest venture capitals of the sector such as a16z, Polychain Capital, and Paradigm. During these investment rounds, DYDX received an investment of $87M.

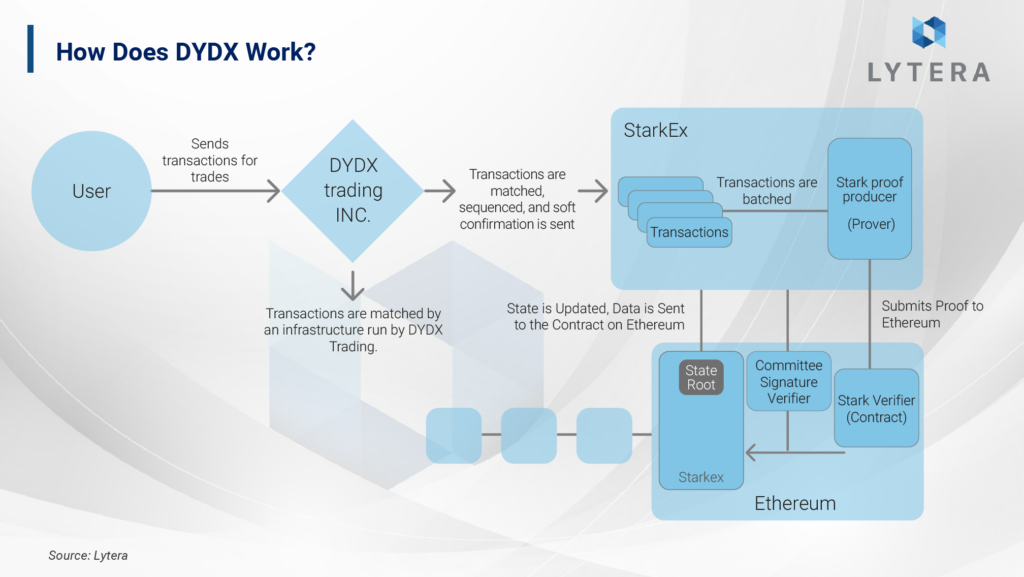

How does DYDX work?

Traders submit their transactions to the infrastructure run by DYDX Trading. The submitted transactions are sequenced by the Sequencer. And a soft-confirmation is sent to the user informing them that the transaction is approved by the Sequencer. In other words, the transactions are matched by a central order book. Afterward, the sequenced transactions are batched and forwarded to the Prover that will produce the Stark proofs. The Stark proofs are then sent to Ethereum, thus, the state transition of rollup takes place. As data is stored on Ethereum, liveness and security of DYDX network is ensured by Ethereum.

In case the Sequencer or the Prover goes offline, the users can call the “escape” function on Ethereum mainnet in order to withdraw their assets from DYDX chain to Ethereum without being subject to the censorship of the Prover and the Verifier. In this way an order book-based exchange for derivative assets can be run in a decentralized manner. Governance token of DYDX was launched in September 2021. In the last quarter of 2022, DYDX will move to a separate chain by halting its rollup activities, as will be discussed at the end of this section.

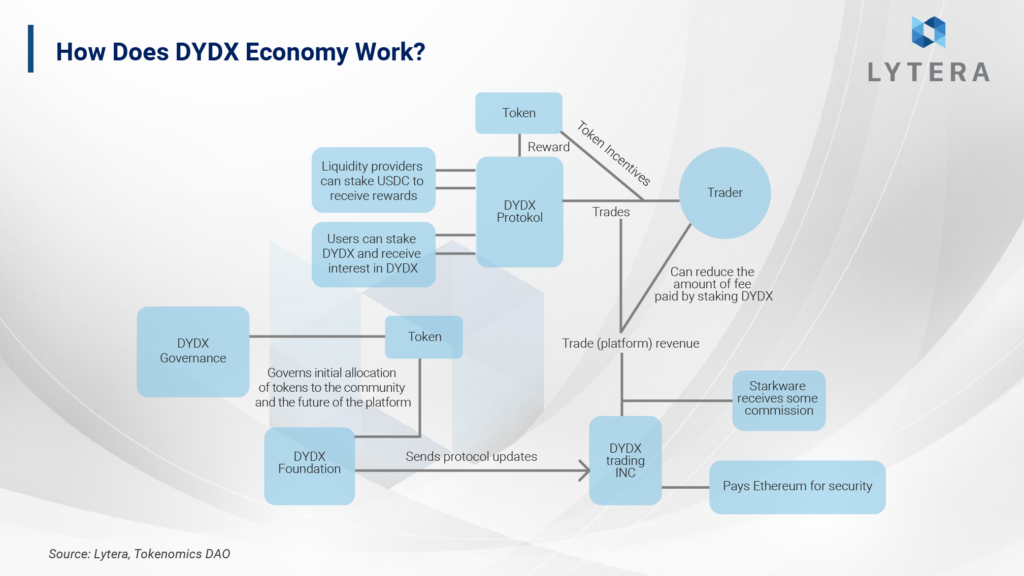

DYDX Tokenomics

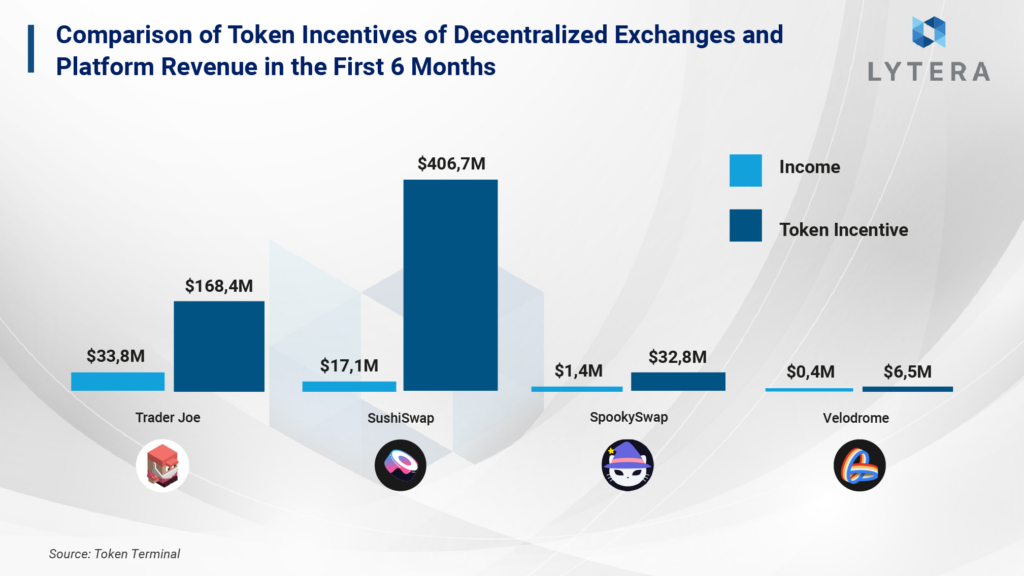

Tokens of decentralized finance (DeFi) products which have been in our lives for the last couple of years haven’t been able to go beyond being governance tokens, which are usually used merely for incentives. While DeFi protocols attracting liquidity to their platforms by giving rewards in the form of tokens have been able to generate considerable amount of income, the price performance of these tokens have been -in most cases- poor.

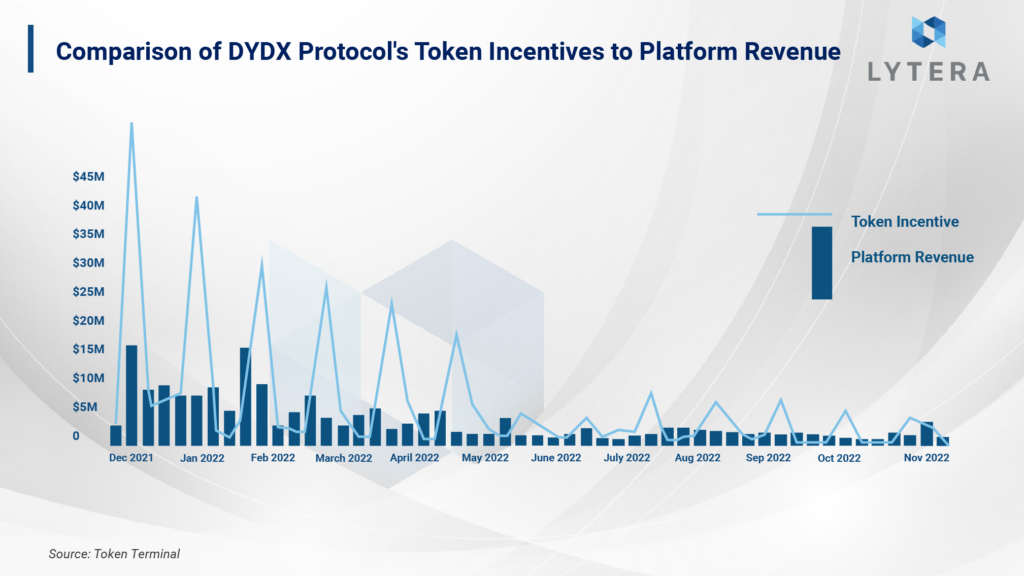

Among the most important reasons for this poor performance are the inability of token holders to share any revenue with the platform or the quite low revenue compared with the amount of token incentives. When we take a look at DYDX, we can see that the platform has achieved a high revenue that is not in any way shared with the token holders.

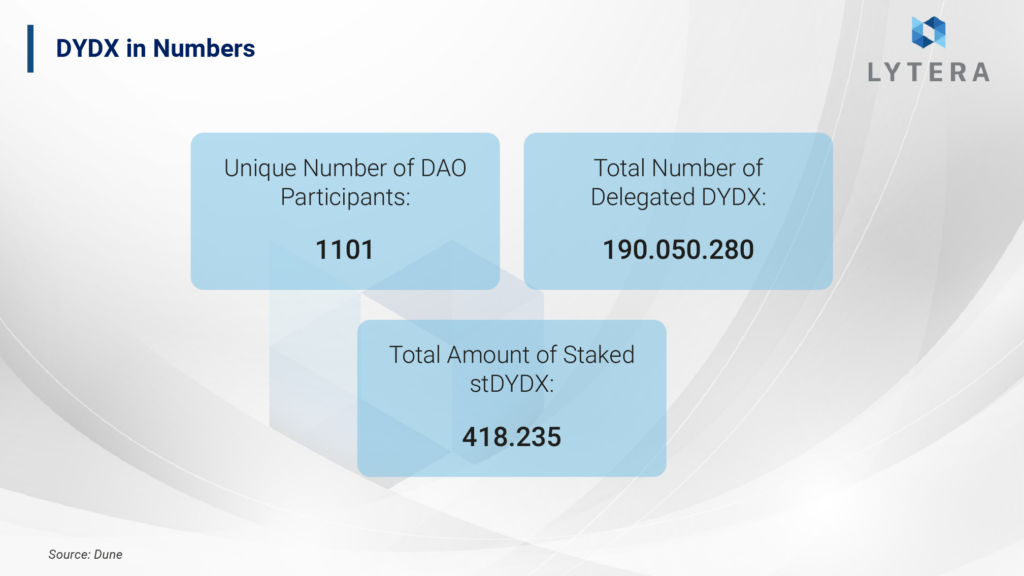

It is also not possible to say that DYDX token holders are not exactly interested in governance despite DYDX is used as the governance token of the platform. The number of unique users who have participated in governance so far is 1101. That is, it seems unlikely that the token used only for governance will create any value through governance, either.

DYDX in Numbers

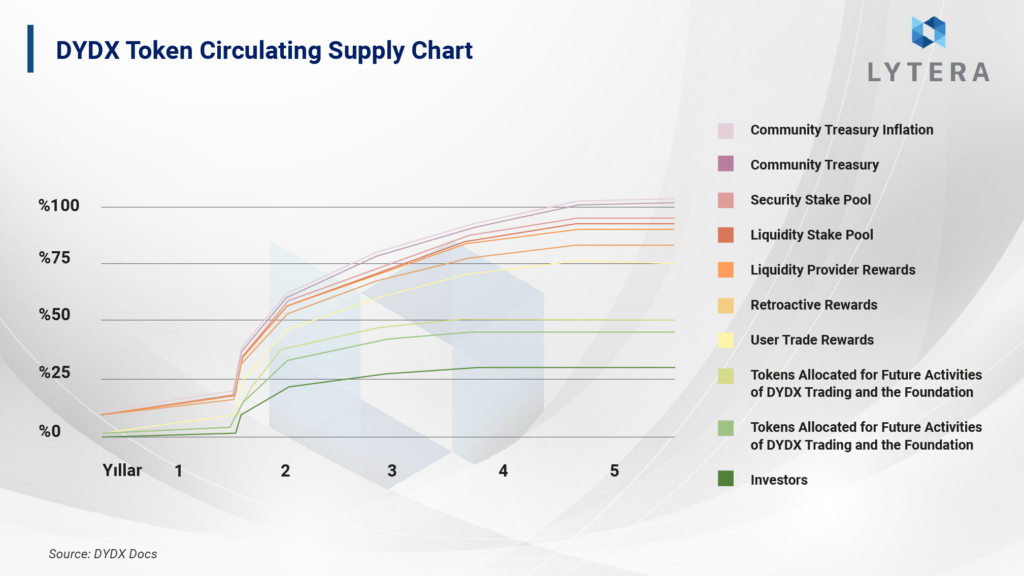

When we take a look at the unlocking schedule, we can see that the first major unlock will take place in February 2023. In addition, considering that DYDX V4 will be shipped in the first quarter of 2023, it is obvious that 2023 Q1 will be rather volatile for $DYDX.

DYDX V4 and Sustainable Economy

DYDX must have figured out that the token economy on their platform is not sustainable that they introduced an upgrade that would change the tokenomics as a whole. This update, called DYDX V4, will cover the following:

- It has been announced that DYDX will no longer server as a rollup and will transition to become a completely sovereign layer one project: Since DYDX uses Starkware’s product, StarkEx, for infrastructure and since almost all the codes constituting the backend is written by Starkware, they need to pay Starkware a large amount of money from the revenue the platform generates. Moreover, according to DYDX founder Antonio Juliano, they decided to take these steps to become a sovereign layer one project as rollups fail to provide sufficient TPS. When we combine these two elements, the reasons why DYDX V4 wants to continue its journey as a sovereign layer one project rather than as a rollup become rather clear.

- The platform is aimed to be completely decentralized. Currently, the incoming orders are being matched by a central actor. All processes such as this are going to be decentralized.

- Along with decentralization, the token will have a valuable use case. It is an undeniable fact that the main problem in DYDX economy is the inability of token holders to make a profit from the platform revenues and that the platform will face regulatory obstacles if they decide to implement a central buyback mechanism or to distribute dividends. For this reason, an entirely decentralized architecture where revenue is collected by validators will be much more advantageous in terms of the sustainability of the token and for the problems to avoid regulatory obstacles.

As the period where token inflation is getting higher corresponds to the launch of DYDX V4, aiming to enable the token to share revenue with the platform, which will be a great step into achieving a sustainable token economy, it is difficult to make speculations about the price. But, one thing is clear that the following months will be pretty volatile for DYDX.

Final Remarks

In the world of Web2, the value created by a platform’s stock directly depends on the amount of money the end user is willing to pay. In other words, the commission fee that Uber collects when it brings the driver and the user together is the actual value of the company Uber. On the other hand, in the world of Web3, what we encounter is the opposite of this scenario. Namely, what we see is that the tokens are distributed as incentives, but the value extracted as incentives usually fail to flow back to the token as a value in return. It is not the intermediary platform and the owners of it (token holders) that makes money, but the developers building the intermediary platform. There are certain regulatory barriers to sharing the value with the token holders. However, it is clear that this system is not sustainable at all. The main obstacle to the sustainability is that almost all layer two projects, primarily the rollups, have not been able to construct a structure that would allow decentralized block production. For now, layer two projects are at an early stage of development, and most have decentralization in their roadmaps.

Layer 2 tokens, which have been launched so far, have been designed to minimize the revenue for the token holders while maximizing the platform revenues. As it is, sustainability is almost impossible. We know the teams are aware of this and are working on it. We will discuss the value creation in the tokenomics of layer two tokens to be launched in the future in our next report!