- Wash Trade has become an inevitable part of the NFT world. It is the result of a desire to manipulate prices and to receive rewards from the platform by a single person.

- 45% of the total NFT volume on Ethereum ecosystem and 1.5% of all NFT buy/sell transactions are wash trades.

- Wash trade is prevalent in NFT marketplaces mainly in LooksRare, X2Y2, Element, Blur, and Sudoswap.

- Although there are many reasons to perform washtrade, the main reason is the token rewards by NFT platforms based on trade volume.

Introduction

Since its early days, we all know more or less what the cryptocurrency market has had to go through to survive, impacts of regulatory decisions, macro movements, bankruptcies, hacks, and many others. In this ecosystem, manipulations and deceptive statistics have been an inevitable part of the cryptosphere. Speculations and manipulations have always been a crucial part of price changes. It is often observed that the excitement surrounding an asset can lead to an increase in both attention and trading activity, whether in traditional financial markets or decentralized finance.

A recent example is the price movement of Dogecoin in response to Elon Musk’s tweets.

Despite being clearly banned in traditional finance, wash trade is a subject which gives us lots of statistics to trace in the world of cryptocurrencies and NFTs. And in this research report, we will focus on wash trade activity in the NFT ecosystem by examining our extensive NFT dataset.

What is Wash Trade?

Wash Trade refers to transactions where the buying and selling are done by the same trader. It creates an artificial activity, which enables prices to be manipulated. It is mostly carried out by creating buy/sell orders in real-time on stock markets. For example, a trader buys 100 shares and sells those 100 shares instantly. These transactions don’t make a difference in reality other than just increasing the market liquidity and when the liquidity increases, the demand is attracted to the specific market/share, thus the intended pricing action is attempted to be achieved.

Such actions have been illegal for quite some time in traditional markets, however, in cryptocurrency markets where the impact of regulations are relatively lower, wash trading manipulations exist. Main reason for this could be the fact that liquidity and volume have a more critical role in the cryptocurrency markets. Another reason could be that volume created in decentralized finance is rewarded by the protocols, incentivizing people to benefit from these yields.

When the total volume on the most prominent exchanges in the cryptosphere is examined, it is seen that from 1.34% to 6.67% of total volume is created as a result of wash trade. It is possible to observe that the volume of wash trading reaches up to 99% on unregulated, not well-known exchanges which are relatively. In a review conducted by Kaiko, it is observed that the volume increases in specific pairs when Binance removes transaction fees for those pairs.

Wash Trading in NFT World

In the research report, the main subject is the role of wash trading in NFT ecosystem. Anyone dealing with NFTs knows that wash trading is used to create volume and manipulate prices. It is especially used to create an artificial hype in the NFT markets. Unlike assets in other token standards, NFTs are illiquid assets. As a result, wash trading transactions are carried out at once, with high volume and in a way that creates excessive value.

Why is Wash Trading So Common in NFTs?

It wouldn’t be wrong to state that the interest in NFTs is formed around “hype” since the early days. The universe of collections has captured high volumes by attracting masses in certain periods.

- Wash Trading and Hype

We know that the volume data is closely monitored for NFT collections. To provide a statistical prediction, volume is among the first data points that is promoted on NFT marketplaces. A collection with high volume is usually seen as a suitable investment space for NFT traders.

In this context, some assets are sold and bought by the same individuals in some NFT collections to create some fake volume. This fake volume allows NFT collections to stand out on the NFT marketplaces, which, in turn, creates some fake hype. While this artificial volume is triggered by the collection owners, sometimes, we can see the investors in specific collections do the same as well.

- Token Incentives

The topic that would allow us to get the most clear output regarding wash trading in NFTs is probably the token incentives by marketplaces. As an application model, NFT marketplaces usually charge fees both for the NFT creator and for the platform itself. Some platforms reward their users with tokens valued in relation to these collected fees.

And incentive rewards are usually distributed based on trade volume in addition to transactions or NFT listings. Later in our research report, we will be discussing the role of wash trading in terms of the distribution of incentive rewards.

- Money Laundering

Although not directly within the scope of wash trade, it has been claimed that art works (including NFTs) were used as a method for money laundering. Nevertheless, no significant association was found between money laundering and wash trading when on-chain data was examined.

How to Detect Wash Trading in NFTs (Methodology)

Many of the NFT marketplaces utilize a variety of filters to exclude wash trading volume. Moreover, various methods have been developed to detect wash trading for analysis purposes. In this research report, the analysis is done on the wash trading data that is obtained from the Polya washtrade filtering methodology.

Four strategies are developed to detect these inorganic transactions.

- The first filter sorts out the trades if the buyer and seller address are the same.

- The second filter flags the tokens as wash trades if they are traded between two wallets more than 10 times.

- Another detection strategy is based on the trade volume of the NFT collection. This method is applied due to the possibility that a large majority of the volume distribution might be the result of wash trade. With the IQR (Interquartile range) method, tokens that are outside the 25% and 75% range are flagged as wash trades . However, since a lot of tokens were detected as wash transactions within this range, another criterion was added. As a result of adding this last criterion, we are able to rescue the rare and worthy tokens from being marked as washtrade.

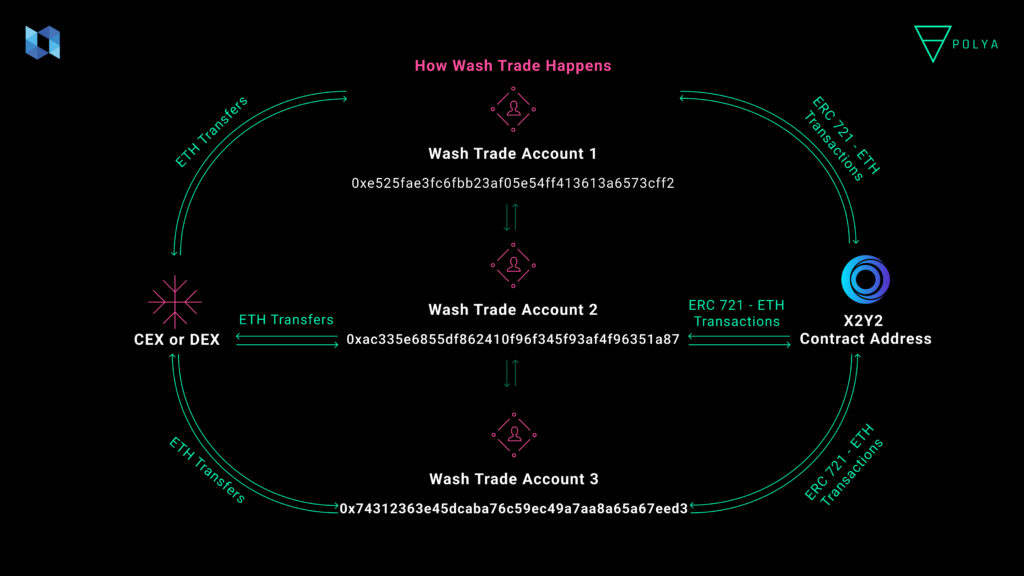

So how do wash trades take place between these wallets?

The wallet transactions shown above indicate a wash trade that took place on the Dreadfulz NFT collection; we can observe that three specific wallets perform transactions on X2Y2 where the rewards become high for a particular token.

Based on examples like these, we can categorize the movement patterns of NFT wash trade transactions into four main schemes.

1) Buyer = Seller

In this scenario, buying and selling transactions on the NFT marketplace are executed by the same wallet. Although it is not a common scenario nowadays, it was observed especially when NFT hype first appeared.

2) Back and Forth Transactions

In this scenario, two wallets buy and sell the same NFT on the marketplace reciprocally. It is the most common model to create the highest wash volume.

3) Three or More Buy/Sell Transactions

It is a model that can be interpreted as both a movement detection and wash trade filtering method. It is the detection of NFTs susceptible to wash trading for the collection in terms of its price, and then observed to be traded again in the same wallet addresses

4) Buyers/Sellers Funded from the Same Wallet

This transaction model can be interpreted as the funding of addresses that perform multiple wash trades by the same centralized exchange address. It is observed through the detection of different wallets, which do not make transactions between each other, but with the same NFT, and in the end, withdrawing to a certain CEX wallet.

NFT Wash Trading in Ethereum Ecosystem

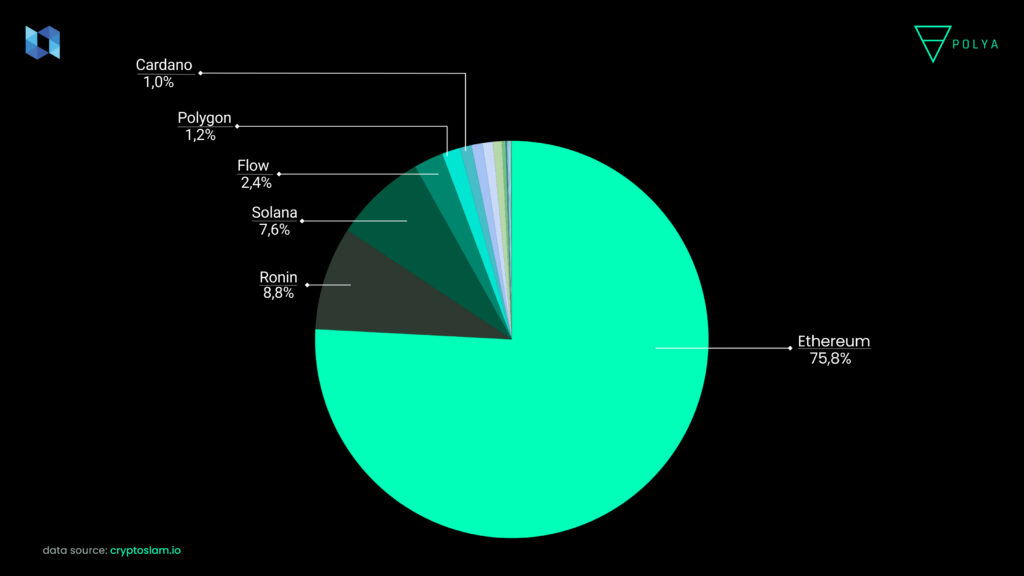

Ethereum can be argued to be the blockchain which enabled the development of the NFT world in terms of hosting the first collections. Wash trading on Ethereum is worth examining as many marketplaces gather their communities on Ethereum and as it hosts approximately 75.6% of all NFT volume.

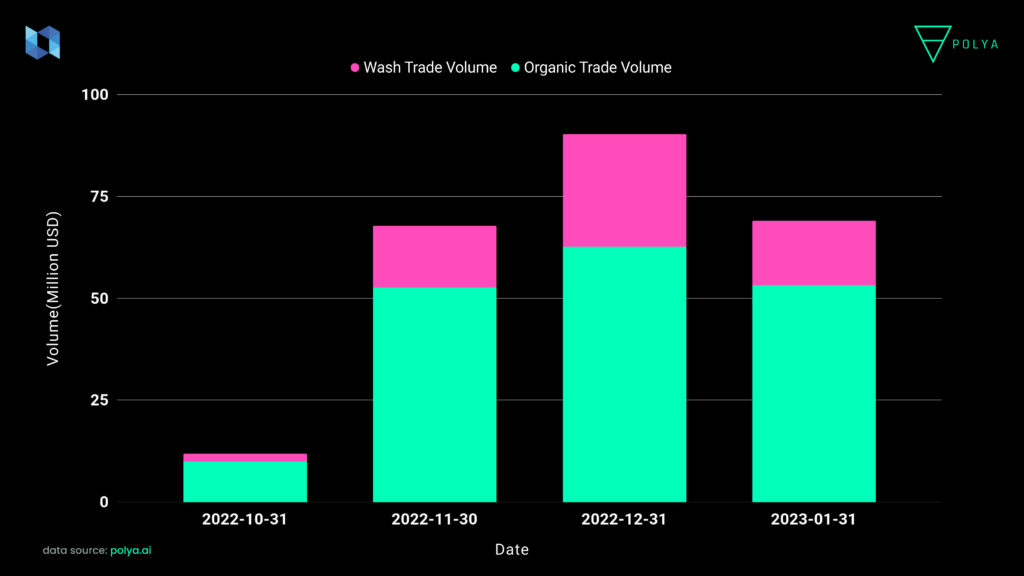

NFT Wash Trading Volume by Months

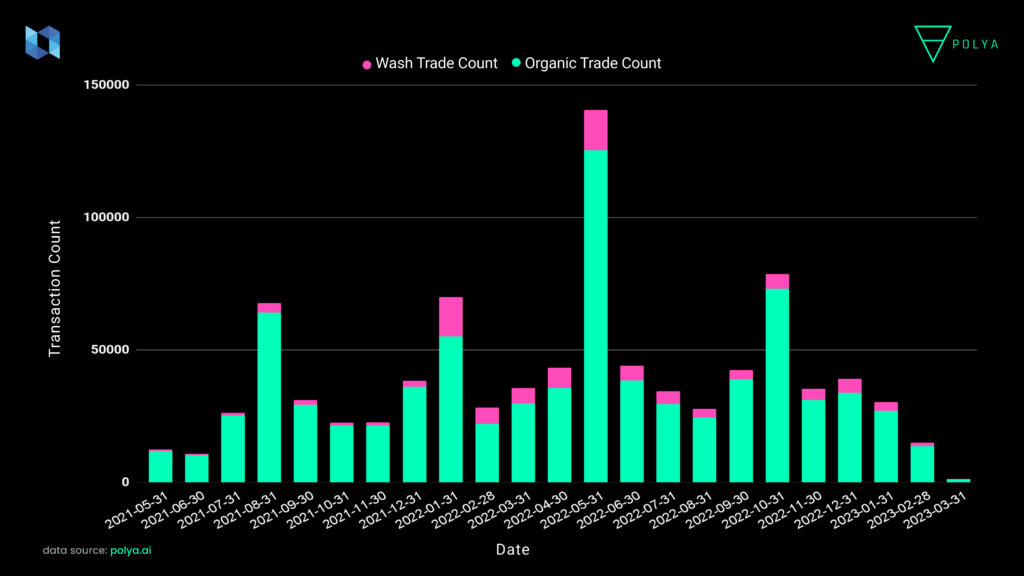

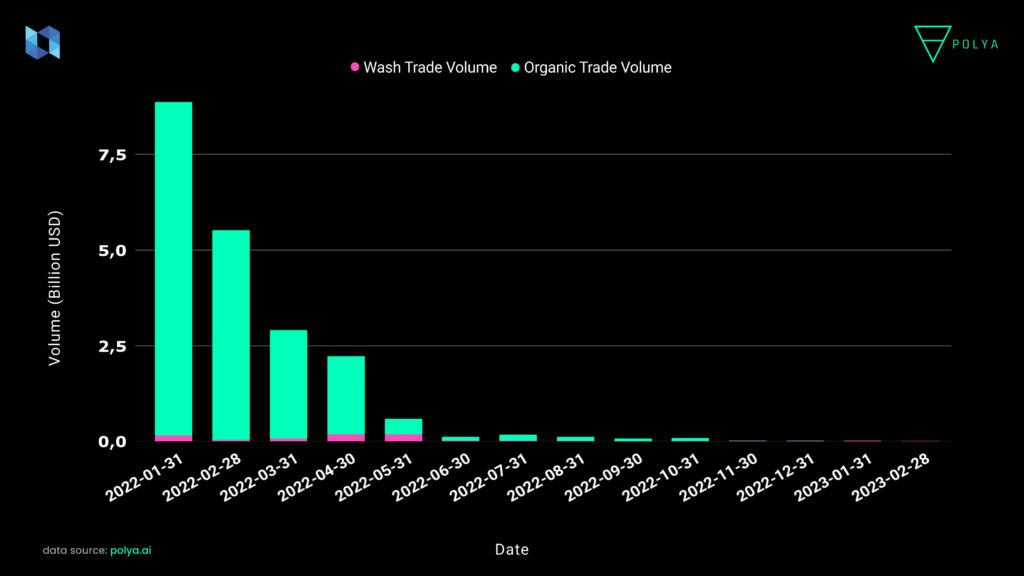

There are striking statistics for all NFT wash trading volume detected on Ethereum. In order to better evaluate the wash trading transactions, we examined 46 dominant collections from Ethereum . Between 2021 and 2023, 37% of all trading volume on these collections are wash trading transactions.

Approximately 45% of all trading volume between 2021-2023 were wash trading. While wash trade volume constituted only 10% of the total volume before 2022, a dramatic increase happens in wash trading volume after 2022.

So far, it is seen that January 2022 was the period where wash trading volume is highest. For this month , total wash trade volume is 4.4 billion USD. Also in percentage terms, the month with the highest wash trade volume is July 2022 with 61.09%. This increase in the trade volume might be related to the fact that a lot of token incentives from NFT marketplaces and speculation around airdrops happened, it was quite active for the NFT craze on Ethereum.

Number of Wash Trade by Months

Compared to a scenario where 37% of all NFT trades are wash trades, the number of transactions seems to be more encouraging. In our observations on the dataset of 46 collections, only 10.5% of all NFT buy/sell transactions are identified as wash trades. Between 2021-2023, April 2022 was the highest with 17.4%. We can note that the highest transaction count was in April 2022 with 15.255 wash trades incidents.

How is it possible for only a relatively small portion of trades to be wash trading when almost 37% of the entire NFT volume was composed of wash trade?

As emphasized earlier in the report, wash trades are typically carried out by the same person between two different addresses, and for this to continue consistently, the prices of NFT collections should not be based on their floor prices or rarity. Therefore, buying and selling of NFTs occurs at a significant premium above their current floor value. Another conclusion that can be drawn is that the wash process execution curve was only adopted by a relatively small group of people.

The filtering systems of NFT marketplaces, as well as the possibility of decreased incentives or the lack of airdrop expectations, reduce the reasonable desire for conducting wash trading transactions.

What is Changing in NFT Marketplaces?

We are aware that NFT marketplaces are platforms that introduce users to many collections and curators. At this point, NFT marketplaces are responsible for attracting collections and creating a community. This is exactly the main motivation behind marketplaces’ attempts to attract more users with incentives such as LooksRare’s vampire attacks. More volume and transactions means more revenue for the platform. Let us take a look at how wash trading is shaped within this context.

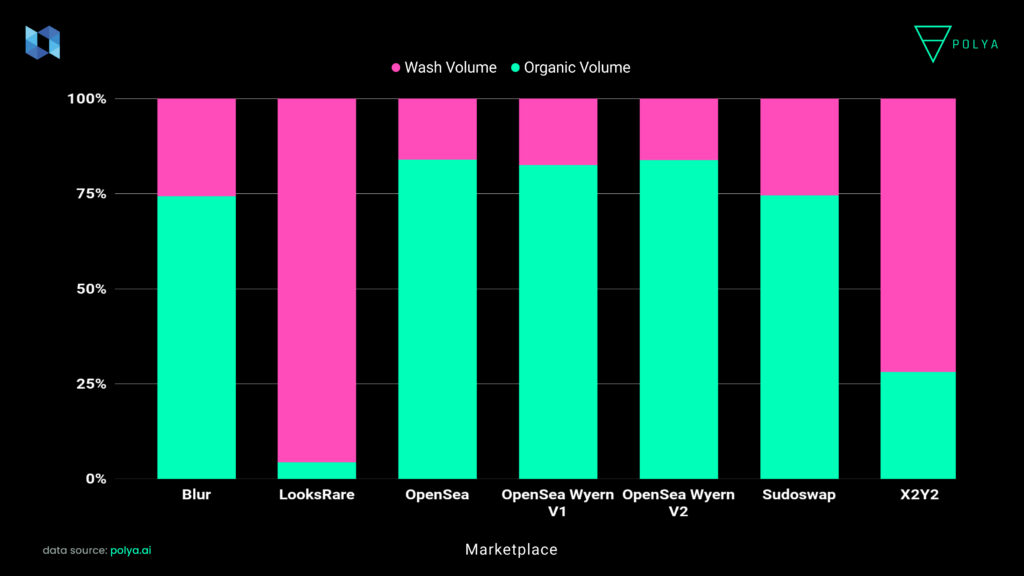

If we are to look at the percentage of wash trading among NFT marketplaces and aggregators that stand out by volume:

- LooksRare: 95.96%

- X2Y2: 72.92%

- Element: 64.44%

- OpenSea: 16.06%

- Blur: 11.06%

- SudoSwap: 10.63%

are among the evident ones. Now, let us discuss why the percentage of wash trading is high in these NFT marketplaces.

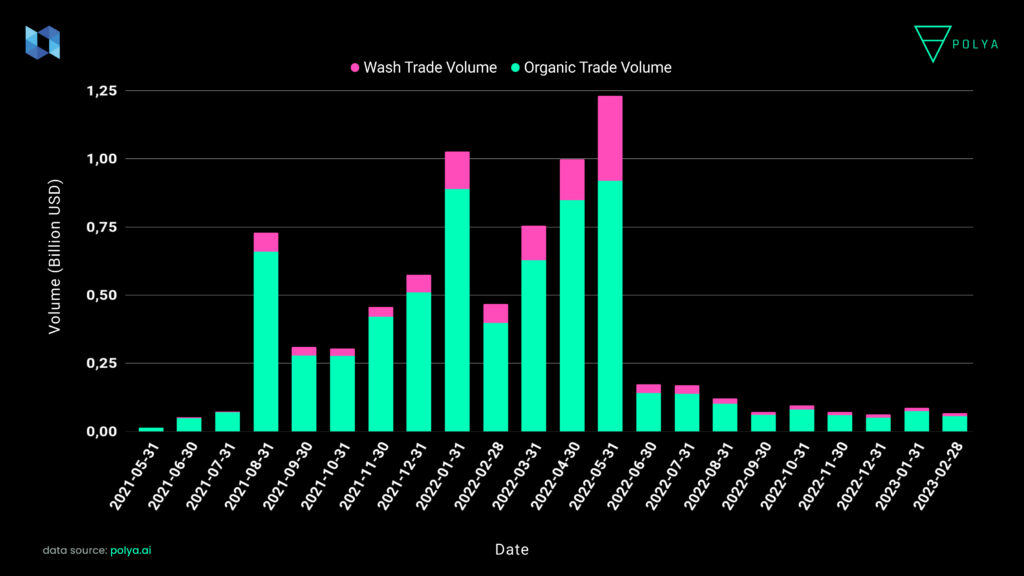

a) Looksrare

LooksRare, the NFT marketplace with the highest volume of wash trading, stands out among all other NFT marketplaces with a total wash volume of $19.940 billion. Behind this, there is a rather basic reason: Token incentives.

LooksRare’s entry into the NFT world with a plan to reward users for their trading activities against the dominance of OpenSea in the NFT marketplace was pretty striking. One of the things that strengthened the $LOOKS token incentive of LooksRare, which managed to steal a significant volume from OpenSea especially in its first month, was that there were not actually filtering wash trades. In addition, the absence of ‘royalty’ fees in some collections also attracted wash traders to their platform. However, after the first month, the hype created by the token incentives, which was not particularly profitable for wash traders, gradually faded after a certain period of time.

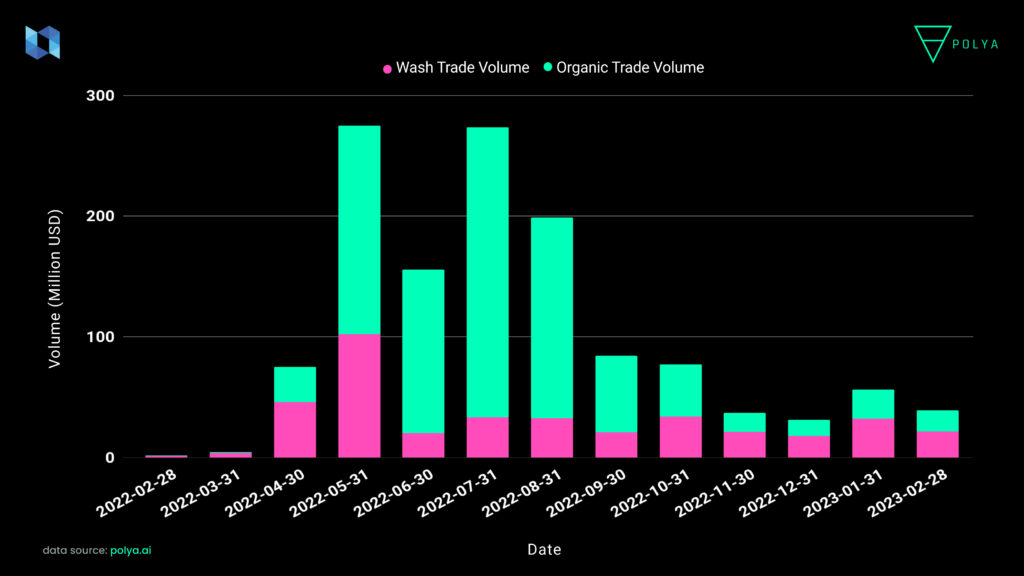

b) X2Y2

X2Y2, the most well-known platform among NFT marketplace aggregators, comes in second place with a total wash trade volume of $0.93 billion. We can argue that the presence of a token reward system, as in the case of LooksRare, was again a contributing factor to X2Y2’s prominence. Similarly, the platform has created a significant hype in its early days which gradually diminished in the following months. However, it is worth noting X2Y2 continues to host a considerable amount of wash trading.

Based on the tables above, there are some striking points that we can take a closer look. If we look at the token yield, we can say that LooksRare has yielded 21 times more than X2Y2. However, another thing that can be seen in both examples is that the price of platform tokens also dropped due to the bear market. For this reason, both platforms were unable to continue providing the initial yield to their users. Despite all these, although LooksRare distributed more rewards, X2Y2 has a more organic volume.

c) Element

The main reason for Element NFT marketplace to rank third with a NFT Wash Trade volume of 64.54% is airdrop. It presents itself as a platform that defines airdrops to their users based on certain tasks and within certain dates.

d) Opensea

The wash trade rate for NFT marketplace giant OpenSea has been limited to 13.54% since June 2021. It can be speculated that the rumors of airdrops that frequently surround OpenSea may have resulted in wash trading volume from time to time. Nevertheless, it should be noted that wash trades are not exactly investable because there is no direct reward for such trades. Despite all, it reached the highest wash trade rate with a 25% transaction volume in May 2022.

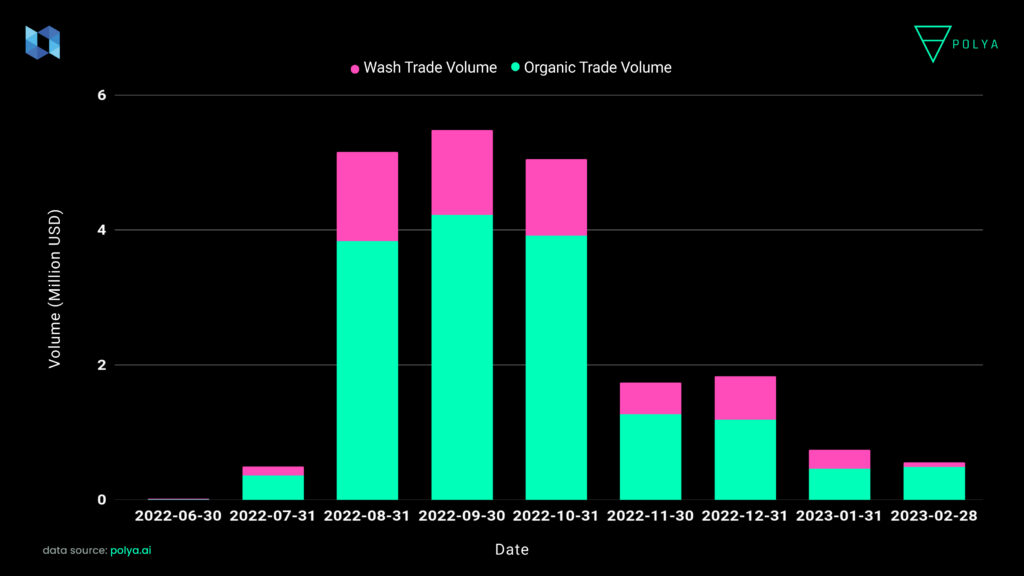

e) Blur

Similar to Element in terms of platform model, Blur also enables users to earn airdrops from NFT listing, buying and selling transactions, and transactions performed at specific times. In this context, the platform, which has been providing boxes so far, continues to attract attention by maintaining a potential airdrop narrative. In addition, despite bear market conditions, the wash trading rate for Blurhas a remarkable volume with a rate of14.29%.

f) SudoSwap

SudoSwap is an NFT marketplace that operates based on their sudoAMM that can make illiquid NFTs more liquid. In this context, unlike other NFT marketplaces, providing liquidity with NFTs or tokens in the ERC-20 standard within predetermined NFT criteria was also included. Although wash trade volume was created with airdrop expectations in a similar manner, the percentage of wash trade is less compared to its counterparts.

SudoSwap has a wash trade volume of approximately $10 million with a rate of 25.25%.

We have seen that token rewards and airdrop expectations increase wash trade volume in NFT marketplaces. In addition, we can also argue that transaction fees on platforms and royalty fees reduce the prevalence of wash trading. Therefore, wash trading transactions not triggered for a desire to manipulate the market or resulting from incentives are not profitable. For NFT marketplaces, the reward distribution mechanisms are not really user-friendly. Nevertheless, wash volume seems acceptable to the platform owners as it provides considerable revenue for the NFT marketplace.

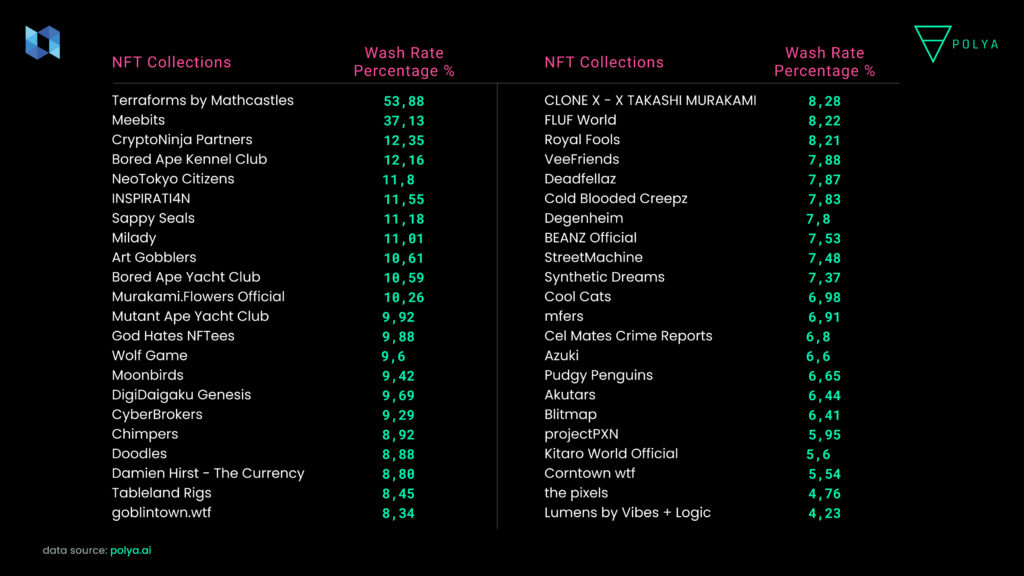

Wash Trade by Collection

We have mentioned that one of the main reasons for wash trade is market manipulation. For this reason, wash trades on collections can be used to increase the value/floor of certain collections.

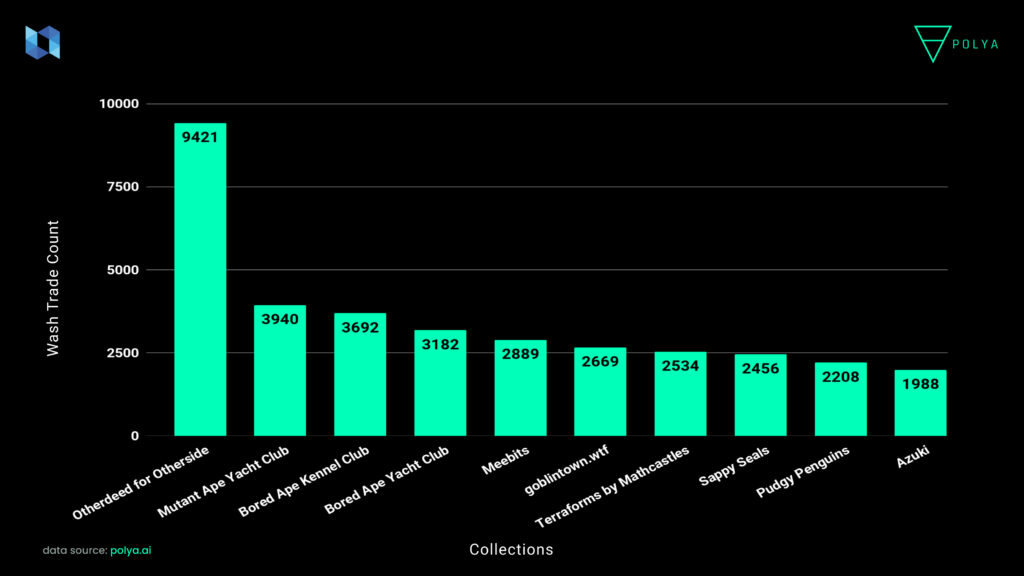

If we are to examine the data compiled by Polya, the most prominent NFT collections in terms of wash trading are respectively;

- Terraforms by Mathcastles – 53.88%

- Meebits – 37.12%

- Crypto Ninja Partners – 12.35%

- Otherdeed for Otherside – 12.19%

- Bored Ape Kennel Club – 12.16%

- NeoTokyo Citizens – 11.8%

- INSPIRATI4N – 11.5%

- Sappy Seals – 11.19%

- Art Gobblers – 10.6%

There are several reasons that can be considered valid for these NFT collections to stand out in terms of wash trading. The main incentive for the addresses that stand out with wash trading is platform rewards, which will be explained in detail later in our report. It can easily be said that the wash trade rates of NFT collections with high volume are high on platforms that provide incentives.

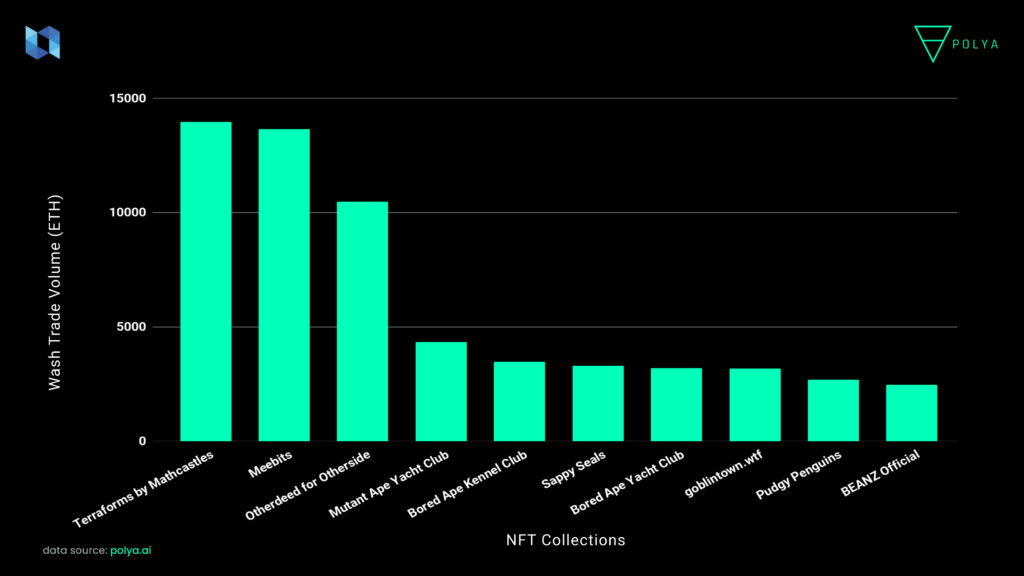

Here are the ten collections with the highest wash trade volume respectively;

- Terraforms by Mathcastles: 13975 ETH

- Meebits: 13659 ETH

- Otherdeed for Otherside: 10467 ETH

- Mutant Ape Yacht Club: 4349 ETH

- Bored Ape Kennel Club: 3474 ETH

- Sappy Seals: 3269 ETH

- Bored Ape Yacht Club: 3194 ETH

- goblintown.wtf: 3172 ETH

- Pudgy Penguins: 2696 ETH

- BEANZ Official: 2458 ETH

With this output, we can state that in some collections with a high number of wash transactions, the wash volume is also high. This may suggest that some NFT collections stand out thanks to wash trade on some NFT marketplaces. We can evaluate these collections based on specific criteria, such as the lack of “royalty” fees in these collections.

What Do Wallets Tell Us?

The number of addresses associated with wash trades for the 46 prominent NFT collections on the Ethereum network is 52888! First of all, we know that the number of wash trades is relatively small compared to the total number of transactions. However, it should be noted that the number of unique addresses that can pass through a certain filtering is quite considerable.

For 10 wash traders with the highest number of wash transactions, what can be said at a first glance is that they are almost exclusively engaged in NFT trading. Although these addresses are considered to be NFT whales,

- NFT Curators

- NFT Collection Owners

- NFT Influencers

are also included.

We can deduce whether they are engaging in wash trading on how many different NFT collections or whether they do wash trade on specific collections by checking these 10 wash traders. In order from the most frequent wash trader to the least frequent:

Wash Trader 1: 5

Wash Trader 2: 1

Wash Trader 3: 7

Wash Trader 4: 9

Wash Trader 5: 1

Wash Trader 6: 19

Wash Trader 7: 2

Wash Trader 8: 9

Wash Trader 9: 20

Wash Trader 10: 10

From this output, there is no direct correlation as to whether the wash trades are concerned with a specific collection or with multiple collections.

If we are to check the focus of addresses filtered as wash traders on specific collections, the collections that stand out are as follows, respectively:

- Otherdeed for Otherside

- Mutant Ape Yacht Club

- Bored Ape Kennel Club

- Bored Ape Yacht Club

- Meebits

- goblintown.wtf

- Terraforms by Mathcastles

- Sappy Seals

- Pudgy Penguins

- and Azuki.

The only context that can show why wash trading is high for the NFT collections listed here is that they are listed on NFT marketplaces that provide token incentives.

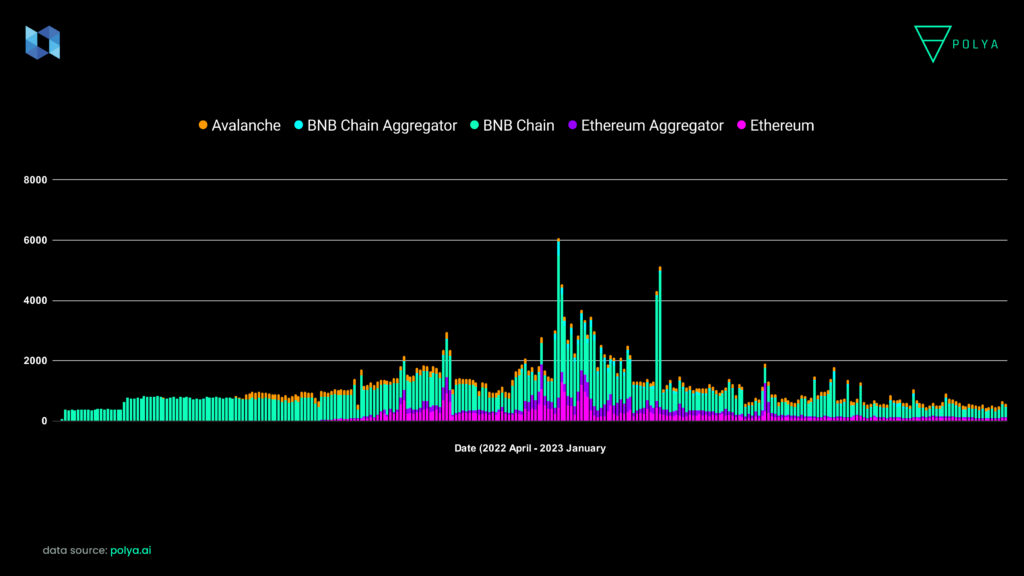

Case Study: Blur Marketplace and Airdrop

Throughout the report, we have seen that token rewards can be associated with wash trade. At this point, the airdrop wash trade/reward association on Blur NFT marketplace on February 14th, 2023 is a valuable case.

You may heard that Airdrop is when a protocol “drops” tokens that meet certain variable special criteria to certain users of the protocol, generally to members of their own community. The rational expectation here would be:

- Rewarding loyal users and even making some of them comparatively rich,

- Creating a marketing strategy, incorporating new communities into the protocol with an expectation of adoption,

- Decentralizing the platform by distributing the governance power to the users.

To understand the model, let us take a look at the criteria of Blur Genesis Airdrop:

- Airdrop 1 was available to anyone who traded within 6 months after Blur marketplace was deployed.

- Airdrop 2 was for users who actively traded and reached above a certain volume threshold until November 2022.

- Airdrop 3 was an airdrop available to users who were actively bidding on NFTs on Blur, who had approximately 1-2 times more volume than the users who were eligible for Airdrop 2.

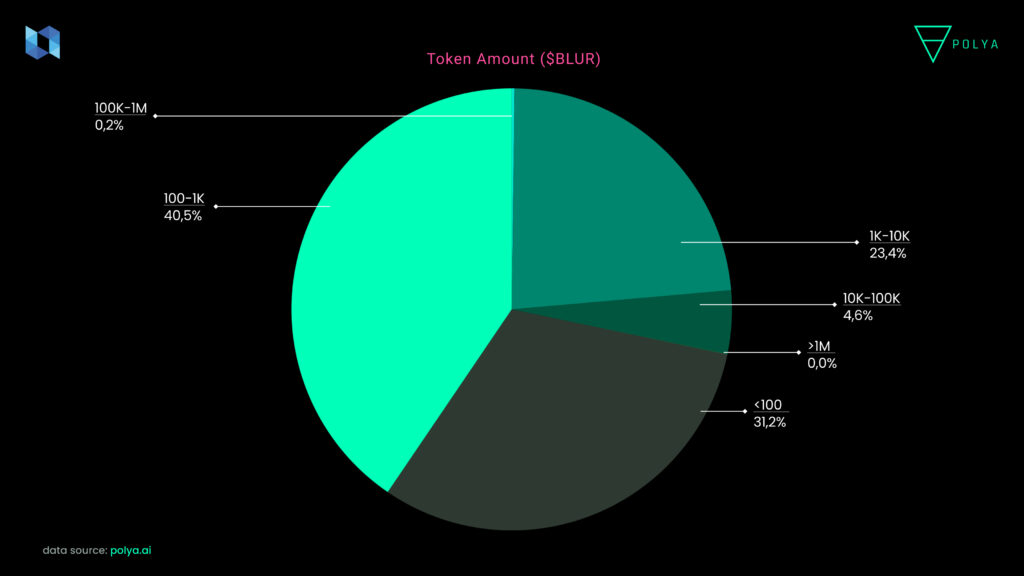

According to these criteria, we can clearly see that Blur somehow encouraged wash trading as volume was a criterion. If we are to evaluate based on data:

- 360,000,000 $BLUR tokens were reserved for users to be distributed within the scope of the airdrop.

- 342,388,876 $BLUR tokens were claimed approximately within 20 days. This amount corresponds to 95.11% of tokens allocated to the airdrop.

Token distribution for 120.5 thousand wallets eligible for the airdrop is as follows:

- 100.000 – 1 Million $BLUR, 0.2%

- 10.000-100.000 $BLUR, 4.6%

- 1000-10.000 $BLUR, 23.4%

- 100-1000 $BLUR, 40.5%

- Less than 100, 31.2%.

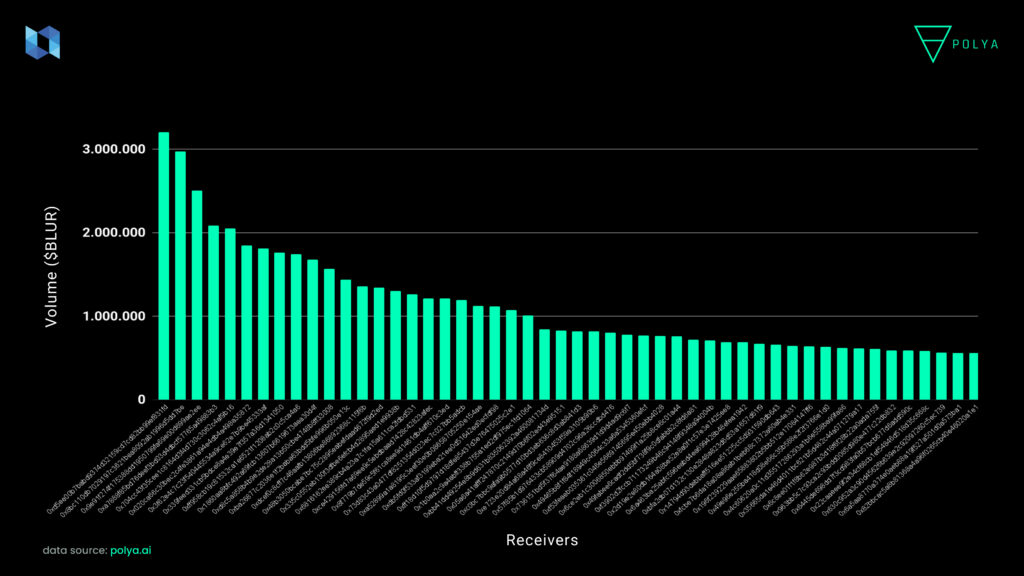

We observed that the majority of eligible addresses got airdropped less than 1,000 $BLUR tokens. So, what did the wallets that received the highest number of $BLUR tokens in the airdrop?

Looking at the top 50 wallets, which hold 15.67% of the tokens allocated to airdrops;

- 37 of them sold all of their $BLUR tokens on either CEXs or DEXs,

- 6 of them sold a certain amount of their $BLUR tokens on either CEXs or DEXs,

- 7 of them are holding their BLUR tokens.

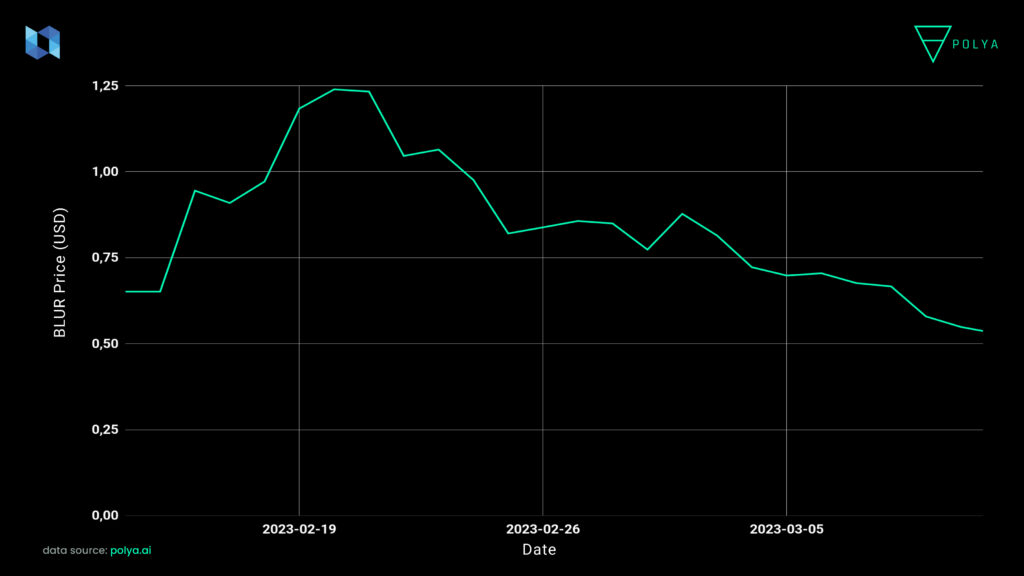

As can be expected after an airdrop, $BLUR token dropped from $5 to $0.65 due to a strong sell pressure by those claiming their tokens. However, after a certain period of time, it was observed that the price somehow stabilized at a certain range following high volatility. Although the conditions are not profitable for holders of $BLUR token or who grew their $BLUR bags yet, the fact that there’s no dramatic drops makes it worthwhile for users to focus on the token.

Finally, Blur stands out as a marketplace for the audience who are constantly trading NFTs thanks to their flexible strategies on Royalty fees. It can be observed that the airdrop, which was sent in packages, has collected a significant amount of organic and wash transaction volume in the marketplace for a considerable period of time However, in order to see a more sustainable business model for the platform, it is worth following how the volume will be like after the airdrop, and how they can stand against the dominance of OpenSea in the future.

Conclusion

NFT Wash Trade transactions are an inevitable part of the crypto ecosystem. From time to time, the number of wash trade transactions increase due to token incentives. It is not a clear-cut issue that is being actively fought against by regulatory bodies or NFT marketplaces as it does not create a considerable reason for direct opposition.

In this context, those who are affected the most by wash transactions are daily NFT users both due to price manipulations and concentration of token rewards into specific wallets. Wash trade will be able to continue on platforms as long as there are token incentives. And the expectation of the marketplaces will be to host high volume on their platform in any case.

However, it is still an issue that should be considered by users as it may affect unique user distribution of NFT platforms and as it may affect the asset distribution of ERC-1155 based games. In the light of our study, we can say that wash trading has a significant presence in the NFT market.

![[PDF] 2022 Kripto Değerlendime Raporu](https://lytera.io/wp-content/uploads/2023/03/kapak2-370x208.png)